Whale distribution and rising trading volume reinforce selling pressure, pushing DOGE below key support near $0.16.

Dogecoin (DOGE) extended its decline on Tuesday, falling over 5% and breaching critical support levels near $0.16, as selling pressure intensified across the broader crypto market. The price action revealed a clear lower-lows pattern, suggesting a deepening bearish trend that continues to weigh on investor sentiment.

DOGE Price Struggles Below Key Support

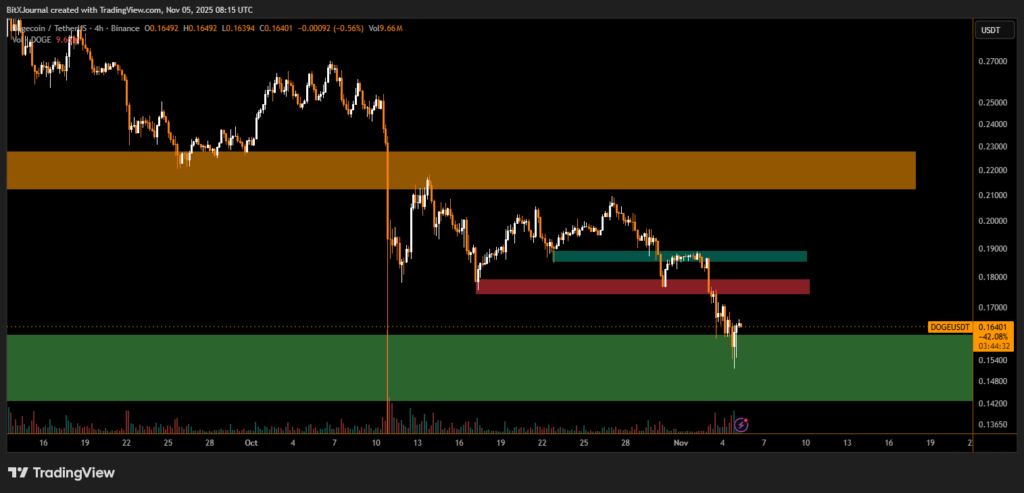

On the 4-hour chart, Dogecoin broke below a short-term support zone at $0.17, triggering a quick descent into the green accumulation zone between $0.15 and $0.14. The move was accompanied by a sharp increase in trading volume, signaling heavy liquidation by whales and institutional traders.

“The break below $0.17 confirms a structural shift,” said BitXJournal crypto market strategist. “With the formation of lower highs and lower lows, the market is now in a clearly defined downtrend.”

The orange resistance band near $0.22 continues to act as a long-term supply zone, while minor resistances have formed around $0.18 and $0.19. Unless the price reclaims these levels, analysts warn that DOGE could face further downside pressure.

Whale Distribution Intensifies Selling

Blockchain tracking data indicates that large holders have been distributing DOGE over the past week, aligning with the recent surge in volume. This suggests institutional-led selling, rather than retail-driven panic.

“Whales appear to be offloading positions into strength, which often precedes extended consolidation or deeper corrections,” said Lucas Nguyen, a technical analyst.

The ongoing outflows reflect a risk-off environment, intensified by macroeconomic uncertainty and declining liquidity across altcoins.

The current lower-lows formation aligns with the broader market’s weakness following a steep drop in Bitcoin and Ethereum. If $0.15 fails to hold, the next downside target could emerge near $0.136, where previous accumulation occurred in mid-September.

“Momentum indicators are oversold but not yet signaling reversal,” BitXJournal added. “A sustained close above $0.18 would be the first sign of short-term recovery.”

Dogecoin’s decline below $0.16 underscores growing bearish momentum, with whale selling and macro headwinds reinforcing downside risks. Traders now watch for a potential rebound from the $0.15–$0.14 demand zone to gauge whether buyers can regain control.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.