XRP breaks below $2.25 amid heavy selling pressure; traders eye $2.08 as the next crucial support to prevent deeper losses toward $2.00.

Ripple’s XRP extended its decline on Tuesday, slipping over 6% in the past 24 hours as the broader crypto market continued to react to Bitcoin’s bearish momentum. The token dropped below the $2.25 support, signaling an ongoing shift in sentiment toward the downside.

The correction came alongside a 126% surge in trading volume, suggesting increased institutional activity during the selloff. Such spikes in volume often indicate strong participation from larger market players, potentially reinforcing short-term bearish control.

“The sharp increase in volume while the price breaks support typically points to strong distribution, not mere retail panic,” explained a BitXJournal market analyst. “This shows smart money positioning for extended downside risk.”

Key Support and Resistance Levels

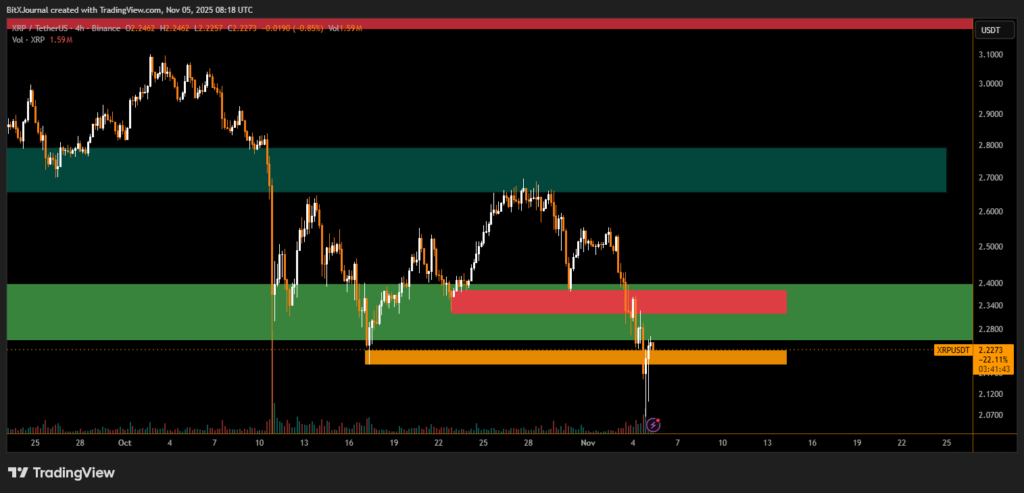

Technically, XRP has entered a critical demand zone between $2.10 and $2.08, marked by the orange band on the chart. A sustained hold above this level could spark a relief rebound toward $2.30, though any recovery remains limited unless price reclaims the red resistance zone near $2.40.

If $2.08 fails to hold, analysts warn that a deeper pullback toward $2.00 or even $1.97 could follow, where historical demand reappeared in October.

“This structure highlights a classic lower-high and lower-low pattern, showing clear bearish continuation,” noted BitXJournal technical strategist. “Until we see a strong close above $2.40, the market bias remains negative.”

The drop in XRP mirrors broader market weakness, as Bitcoin’s recent slide below $68,000 sparked caution across major altcoins. Traders are now closely monitoring liquidity clusters and support reactions near $2.08 to gauge whether bulls can re-enter the market.

XRP’s short-term outlook remains bearish as selling pressure intensifies around key supports. A decisive bounce above $2.30 could stabilize momentum, but sustained downside pressure keeps $2.00 in sight if sentiment fails to recover.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.