Jan3 founder believes fears of Bitcoin OGs selling are exaggerated and that the real bull market could push prices far beyond current levels.

Bitcoin Bull Run Yet to Start, Says Samson Mow

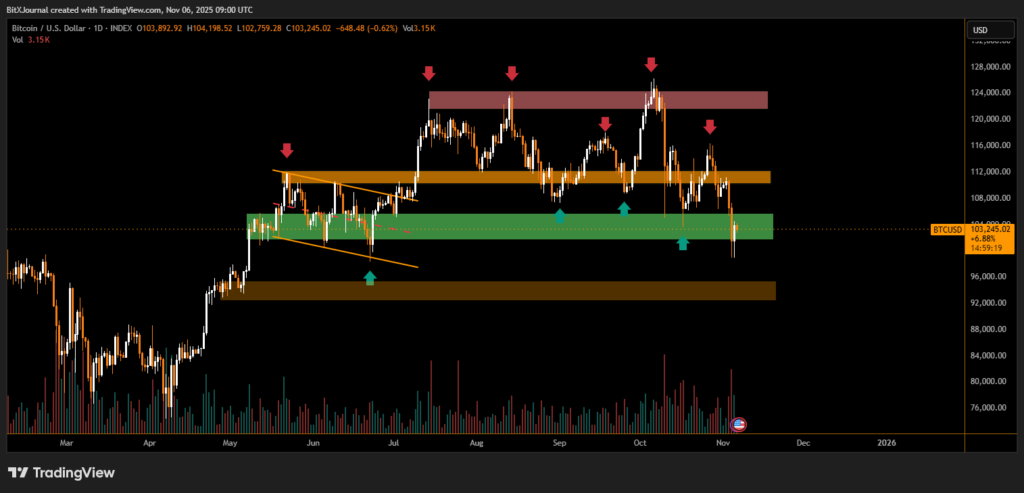

Bitcoin’s recent pullback below $100,000 has sparked renewed debate among traders, but Jan3 founder Samson Mow insists that the Bitcoin bull run hasn’t even begun. Speaking earlier this week, Mow said that the current price movement is only “marginally outperforming inflation,” suggesting that the market’s real upside potential remains untapped.

As of Wednesday, Bitcoin (BTC) traded around $103,148, after dipping to $99,607, according to market data. Analysts attributed the weakness to U.S.-China trade tensions and broader macroeconomic uncertainty. Yet, Mow remains confident that Bitcoin will continue to outperform inflation, which currently stands near 3% in the U.S.

Mow Predicts Long-Term Upside

In a series of posts, Mow expressed optimism about Bitcoin’s trajectory, noting he is “not uncertain” about the possibility of a “Christmas god candle”—a term used to describe a surge in buying momentum. Earlier this year, Mow predicted that Bitcoin could reach $1 million in what he described as a “short and violent upheaval.”

He also suggested that those who believe in Bitcoin market cycles might expect a cycle top in 2026, though he added that the current market might instead evolve into a “generational bull run” similar to gold’s post-ETF growth phase.

“Bitcoin has been basically flat for 2025. If you believe in cycles, then it hasn’t topped,” Mow said. “That means a longer cycle, or maybe no more cycles again—an Omegacycle. Plan accordingly.”

Fears of Bitcoin OGs Selling Are ‘Overblown’

Responding to speculation that long-time holders (OGs) are selling their Bitcoin, Mow dismissed those concerns as “self-owning theories.” He urged traders to focus on the “big picture,” emphasizing that Bitcoin is destined to add another zero in value—it’s only a matter of time.

“People are fearful because they created their own theory that OGs are selling above $0.1M,” Mow explained. “I don’t know any OGs that are selling, by the way.”

While the Crypto Fear & Greed Index currently shows the market in “extreme fear,” Jan3’s proprietary index flips the sentiment, labeling the market as one of “extreme greed”—reflecting the mindset of committed Bitcoiners who “fear missing sats, not price drops.”

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.