While Bloomberg’s Mike McGlone warns Bitcoin could slide to $56,000, on-chain data from Glassnode and other analysts suggest the recent correction is part of a healthy mid-cycle revaluation rather than a full-blown sell-off.

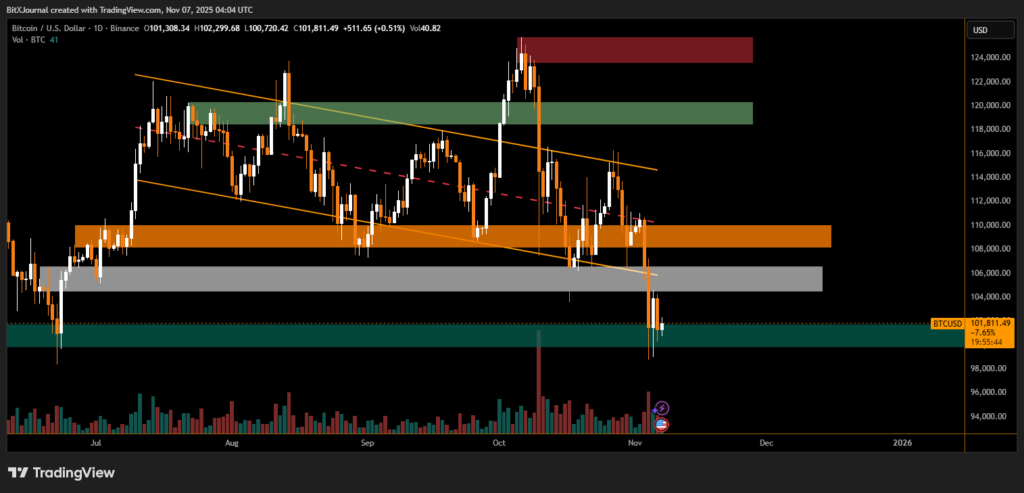

Bitcoin (BTC) continues to face pressure after dipping below the $100,000 mark for the first time in four months, sparking debate among analysts about whether the bull cycle is over or merely taking a breather.

Despite a 7.66% weekly decline, Bitcoin has stabilized around $101,380, with multiple data points suggesting that the market remains resilient and far from panic territory.

Body: Bloomberg Analyst Predicts Reversion to $56K

Bloomberg’s senior macro strategist Mike McGlone said in a recent post that Bitcoin reaching $100,000 might represent only “a speed bump toward $56,000.”

“My look at the chart shows how normal it’s been for Bitcoin to revert to its 48-month moving average, now around $56,000, after similarly extended rallies as in 2025,” McGlone explained.

McGlone’s perspective reflects a traditional market view, expecting Bitcoin to revisit long-term averages following sharp gains earlier in the year.

However, on-chain analytics tell a different story, indicating that Bitcoin’s correction might have already reached its local bottom.

Glassnode and Market Data Indicate Stability

According to Glassnode, Bitcoin’s current pullback mirrors mid-cycle corrections seen in previous years rather than deep bear market behavior.

“Unlike the 2022–2023 bear market, where losses reached extreme levels, the current reading of 3.1% suggests only moderate stress, comparable to past mid-cycle corrections,” the firm stated.

Glassnode’s Relative Unrealized Loss metric—which measures investor losses relative to total market value—remains below the 5% threshold, indicating the absence of capitulation or widespread panic.

Similarly, analysts at XWIN Research Japan highlighted that Bitcoin’s Market Value to Realized Value (MVRV) ratio has fallen to levels that have historically marked local bottoms, suggesting limited downside from current prices.

Long-Term Outlook: Diverging Forecasts

While some traditional analysts anticipate deeper retracements, others believe Bitcoin’s fundamentals remain strong.

ARK Invest’s Cathie Wood, however, recently trimmed her long-term projection, reducing her 2030 Bitcoin price target from $1.5 million to $1.2 million, citing the growing dominance of stablecoins in emerging markets.

Meanwhile, venture investors such as Vineet Budki warn that BTC could face a 65%–70% retracement in the next two years, underscoring the uncertainty surrounding its cyclical behavior.

Despite conflicting forecasts, data from on-chain metrics points to a stable and orderly revaluation, not panic selling.

As long as unrealized losses remain contained and long-term holders stay steady, Bitcoin’s current decline appears to be a natural pause—rather than the end—of its ongoing market cycle.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.