After weeks of volatility, Bitcoin (BTC) has reclaimed the $100,000 level, drawing renewed attention from traders and institutional investors. The move comes amid a fragile macro backdrop, where risk assets have been pressured by tightening liquidity and cautious sentiment across global markets.

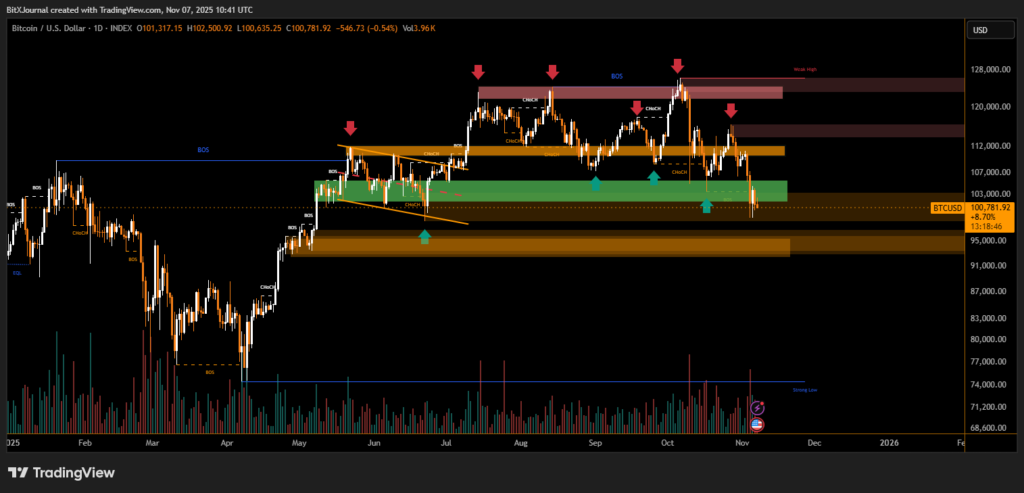

On the daily chart, BTC/USD is trading around $100,803, slightly below its 55-day moving average, signaling that bears remain active but losing control. The price has bounced from a demand zone near $98,000–$100,000, highlighted by strong buying interest on higher volume.

“This area is crucial for Bitcoin’s next trend confirmation,” said one BitXJournal market strategist. “If buyers defend the $100K region, we could see a recovery toward $106K and potentially $115K, but failure here might trigger another leg down toward $94K support.”

Technicals Indicate a Consolidation Phase

The Break of Structure (BOS) and Change of Character (CHoCH) formations on the chart suggest Bitcoin is attempting to shift from bearish to neutral momentum. Analysts are watching for a daily close above $106K, which would confirm a short-term bullish reversal.

Volume profiles indicate accumulation in the green support zone, while resistance remains dense between $110K–$124K, an area where sellers have repeatedly rejected price advances.

“The $100K level is acting as psychological support and liquidity magnet,” noted a technical trader. “Until Bitcoin clears $106K with conviction, the market will likely range and consolidate.”

Liquidity Could Influence the Next Move

Traders are also keeping an eye on global liquidity indicators, as improving funding conditions could spark renewed inflows into crypto assets. Some analysts expect liquidity easing from Treasury operations later this month to favor Bitcoin’s upside momentum.

Still, sentiment remains cautious. “A confirmed breakout above $106K would re-establish bullish confidence,” BitXJournal analyst added. “But if liquidity remains tight, Bitcoin could revisit $94K before attempting another rally.”

As Bitcoin stabilizes, the $100K support zone remains the focal point for traders. A sustained defense here could signal accumulation before a year-end rally, while a break below could extend the correction phase. For now, Bitcoin holds steady at six figures — but the next move depends on liquidity and trader conviction.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.