Cathie Wood’s Ark Invest has doubled down on its confidence in Ethereum-treasury firm BitMine (BMNR), purchasing $9 million worth of shares even as the stock saw a steep 9.8% decline in Thursday’s trading session.

Ark Adds 240,000 Shares Across Three ETFs

According to company filings, Ark Invest acquired 240,507 BitMine shares across three of its exchange-traded funds (ETFs). The purchases included 167,348 shares for the ARK Innovation ETF (ARKK) worth $6.3 million, 48,361 shares for the ARK Next Generation Internet ETF (ARKW) worth $1.8 million, and 24,798 shares for the ARK Fintech Innovation ETF (ARKF) worth approximately $927,000.

Ark’s diversification rule ensures that no single holding exceeds 10% of a fund’s total portfolio, suggesting the firm could continue rebalancing its BitMine position depending on market performance.

Currently, BitMine ranks as the 13th-largest holding in both ARKK and ARKW, and 14th in ARKF — with respective weightings around 2.3–2.4%. Collectively, Ark’s exposure to BitMine across its ETFs totals more than $250 million, placing it among the firm’s top crypto-related equity positions, alongside Coinbase and Robinhood.

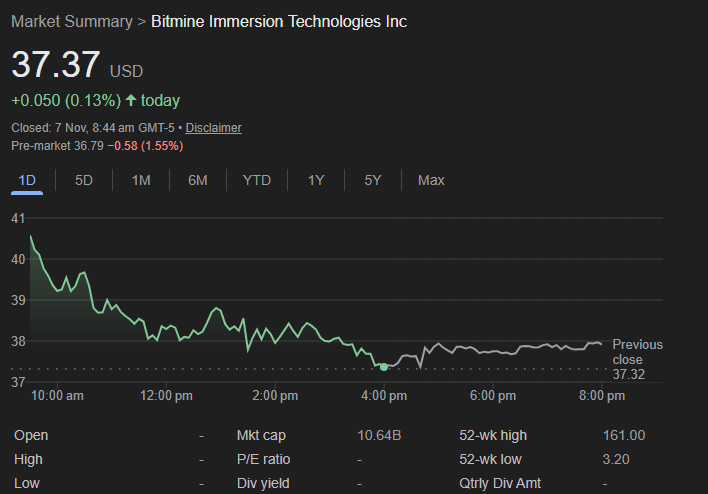

BitMine Shares Plunge but Still Up 769% Since June

BitMine shares closed Thursday at $37.37, down 9.8% on the day and 42.5% lower over the past month. Despite the correction, BMNR remains up 769% since launching its Ethereum treasury strategy in late June — making it one of 2025’s top-performing crypto equities.

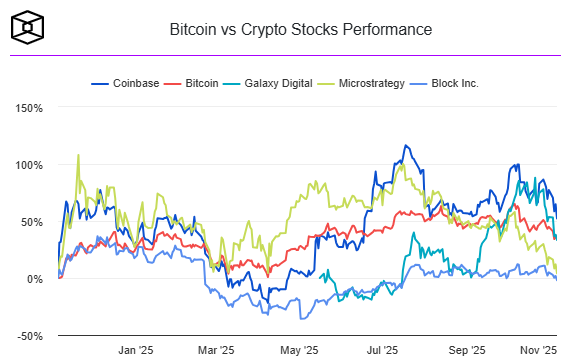

Other digital asset stocks also faced declines, with Robinhood (-10.8%), Coinbase (-7.5%), Circle (-11.5%), and leading bitcoin miner IREN (-12.4%) all trading lower. The broader crypto market mirrored the drop, as Bitcoin fell 2.3%, Ether declined 3.4%, and the GMCI 30 index slid 3.4%.

Founded with support from institutional heavyweights like Cathie Wood, Bill Miller III, DCG, Founders Fund, Galaxy Digital, and Kraken, BitMine is aggressively targeting control of 5% of Ethereum’s circulating supply — around 6.04 million ETH.

As of November 2, the company held 3.4 million ETH, valued at $11.2 billion, cementing its status as the largest Ethereum treasury holder globally. BitMine trails only Michael Saylor’s Strategy, which owns 641,205 BTC ($65 billion), as the second-largest public crypto treasury company overall.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.