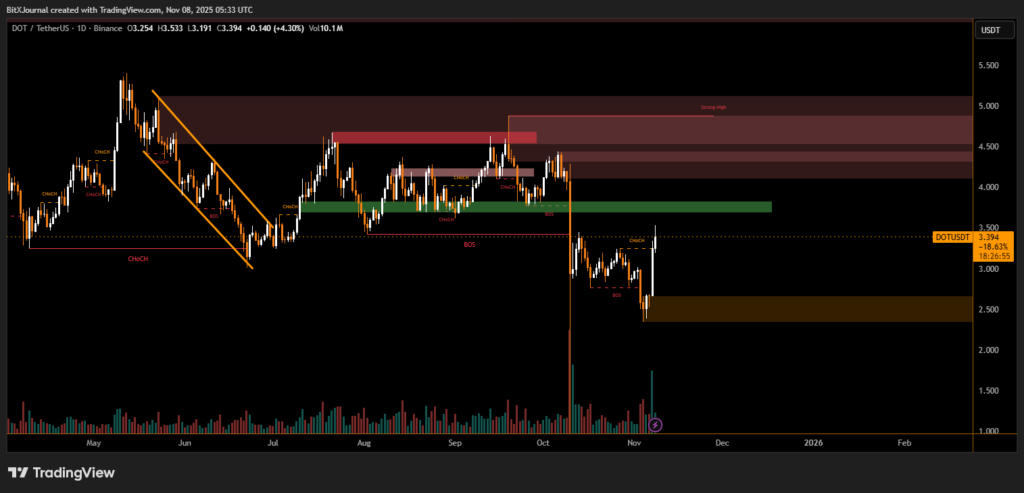

Volume expansion and bullish breakout from range lows hint at early trend reversal.

Polkadot (DOT) surged 5% on Thursday, bouncing from the $3.20 support zone as traders showed renewed buying interest following weeks of consolidation. The move pushed prices to $3.40, supported by a noticeable increase in volume, as market participants responded to signs of strength emerging on the daily chart.

DOT’s recent price action highlights a change of character (ChoCH) from a downward structure to an early bullish phase. The pair broke above near-term resistance after forming a base around $3.10–$3.20, where demand historically tends to strengthen.

Market data shows that trading volume jumped nearly 25% above its 14-day average, confirming that fresh capital has entered the market. “Polkadot has managed to reclaim a critical technical level after sustained selling pressure,” BitXJournal analyst noted. “If the momentum holds, the next upside zone sits around $3.70 to $3.90, aligning with prior liquidity gaps.”

Support and Resistance Zones

The $3.00 region remains key support, where previous structure shifts (BOS) occurred, marking institutional accumulation areas. Above, multiple resistance clusters are visible between $4.00 and $4.50, corresponding to unmitigated supply zones from early October.

A confirmed daily close above $3.50 would further validate the bullish bias, while failure to sustain above $3.20 could invite short-term profit-taking.

Trading volume has continued to rise, hinting at buyer conviction returning after a steep 18% monthly correction. On-chain activity also shows a mild uptick in transaction count, suggesting increasing network participation. Analysts caution, however, that macro factors — including Bitcoin’s consolidation phase — could influence DOT’s short-term direction.

“DOT’s structure is cleaner now, with a clear higher low forming,” BitXJournal market strategist commented. “Maintaining momentum above $3.20 is crucial; otherwise, we risk a retest of the lower band near $2.80.”

In summary, Polkadot’s 5% surge signals a potential turning point after an extended decline. With improving technicals and growing volume, traders will be watching closely for a sustained move above $3.50, which could confirm a broader recovery phase heading into mid-November.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.