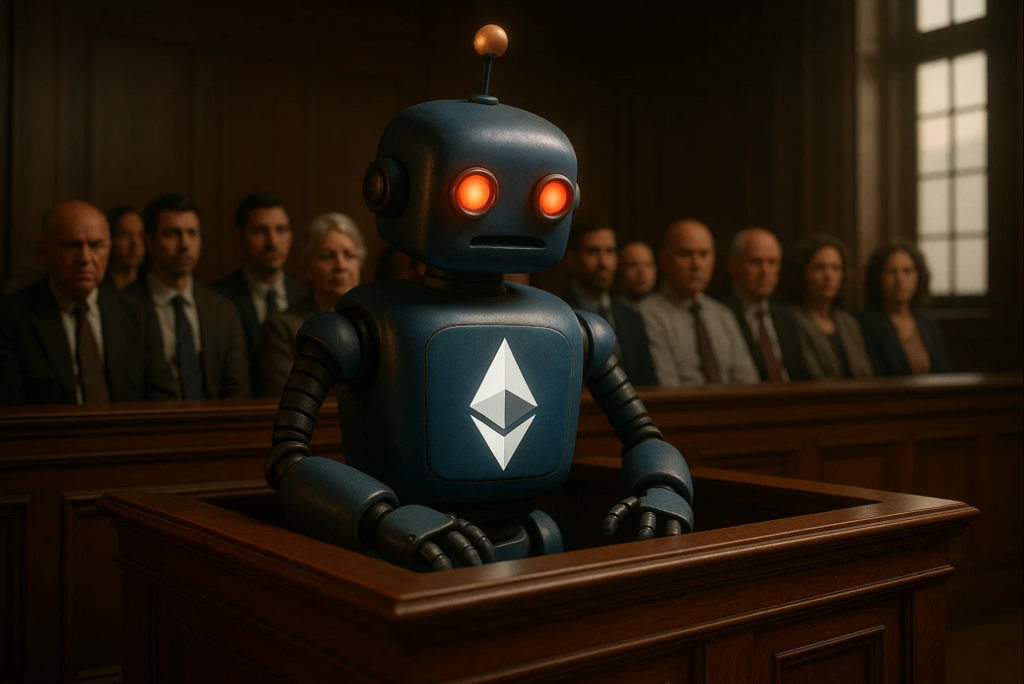

After three weeks of deliberation, a New York jury was deadlocked on whether two MIT-educated brothers committed fraud and money laundering in a complex Ethereum MEV exploit.

A high-profile crypto fraud trial involving alleged Ethereum MEV bot manipulation has ended in a mistrial after jurors failed to reach a unanimous decision. The case, centered around Anton and James Peraire-Bueno, revolved around accusations that the brothers executed a $25 million exploit using blockchain trading bots — a case that could set a major precedent for how courts interpret maximal extractable value (MEV) strategies.

Jury Deadlocked After Three-Week Trial

After a three-week federal trial in Manhattan, U.S. District Judge Jessica Clarke declared a mistrial when the jury was unable to decide whether to convict or acquit the brothers on charges of wire fraud and money laundering. Prosecutors alleged that the pair “tricked and defrauded” other blockchain users by exploiting transaction ordering to front-run trades.

“Bait and switch is not a trading strategy,” prosecutors said in their closing argument. “It is fraud. It is cheating. It is rigging the system. They pretended to be a legitimate MEV-Boost validator.”

The Peraire-Bueno brothers, both graduates of the Massachusetts Institute of Technology (MIT), were accused of using MEV bots to deceive users in what authorities called a premeditated plan. Investigators claimed they spent months researching Ethereum’s validator structure before executing the 12-second exploit that drained $25 million in crypto assets.

Defense Argues It Was Legal Blockchain Arbitrage

The defense countered that the brothers’ actions were not criminal, likening the exploit to “stealing a base in baseball” — opportunistic but within the game’s rules.

“If there’s no fraud, there’s no conspiracy, there’s no money laundering,” the defense team said, asserting that the brothers operated within Ethereum’s open-source and permissionless design.

This argument resonated with some jurors, ultimately leading to the deadlock that forced the court to declare a mistrial.

Industry Reactions and Legal Implications

The mistrial has sparked intense debate across the crypto industry, as legal experts and developers question whether MEV activity should be criminalized. Advocacy group Coin Center filed an amicus brief defending blockchain innovation and warning against treating MEV extraction as a criminal act.

“I don’t think what’s in the indictment constitutes wire fraud,” said Carl Volz, a partner at Gunnercooke law firm, adding that the prosecution’s case relied heavily on “intent and interpretation rather than clear criminal behavior.”

The Peraire-Bueno case highlights the growing tension between decentralized technology and traditional legal systems. With no verdict reached, the mistrial leaves open critical questions about how courts will define ethical versus illegal blockchain behavior in future cases. As the government weighs whether to retry the case, the crypto community watches closely — knowing that the outcome could reshape the legal boundaries of blockchain innovation.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.