Rapid price surge may lead to a “blow-off top” as experts urge caution amid Bitcoin’s volatile climb past $100,000.

While many crypto investors dream of seeing Bitcoin (BTC) soar to $250,000, some analysts warn that such a move could backfire. According to macro strategist Mel Mattison, a rapid surge to that level could trigger a massive sell-off, causing sharp market instability rather than sustainable growth.

Analyst Warns of ‘Blow-Off Top’ Scenario

Speaking in a recent interview, Mel Mattison cautioned that a sudden rally in Bitcoin and traditional equities could spell trouble for the broader financial market.

“One of the worst things that could happen is Bitcoin shoots up to $250,000, and the S&P to 8,000 in a 3-month period,” Mattison said. “You get this blow-off top, and everybody rushes to the exits to take profits, and it starts going down.”

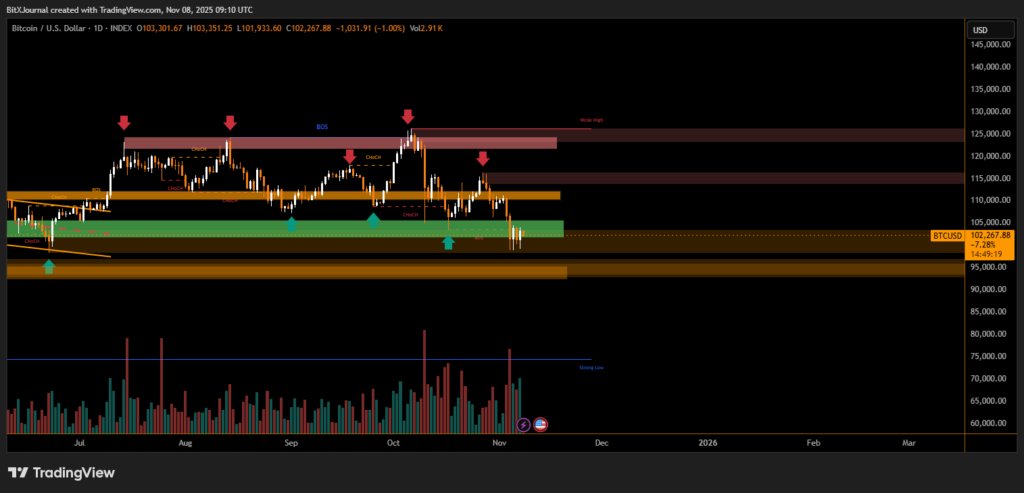

A move to $250,000 would represent an astonishing 142% gain from Bitcoin’s current level of around $102,000, according to BITXjournal. Analysts warn that such parabolic growth often precedes deep corrections — a pattern seen in previous bull market peaks.

Bitcoin Shows ‘Healthy Rotations’ Despite Drop

Bitcoin recently dipped below $100,000 for the first time in four months, falling more than 16% over the past 30 days. Despite this pullback, Mattison described the market as undergoing “healthy rotations” and said the current correction may be part of a broader consolidation phase before the next leg higher.

“We’re having healthy movement and reaching some key technical zones,” Mattison noted, pointing to channel-based analysis supporting the current price action.

Experts Split on 2026 Outlook

Market opinions remain divided on where Bitcoin heads next. Arthur Hayes and Tom Lee maintain their bullish target of $250,000 by year-end, while Canary Capital CEO Steven McClurg expects Bitcoin to close 2025 between $140,000 and $150,000 before entering a bear phase in 2026.

However, Bitwise CIO Matt Hougan disagrees, projecting another “up year” in 2026, countering the traditional four-year cycle narrative. Galaxy Digital CEO Mike Novogratz added that reaching $250,000 by December would require “planets to almost align,” hinting at how extreme such a rise would be.

While Bitcoin’s long-term outlook remains optimistic, analysts caution that a rapid rise to $250,000 could harm market stability. Experts emphasize the importance of measured growth and healthy corrections to avoid the “blow-off top” that often ends major bull runs. For now, Bitcoin’s consolidation around the $100,000 mark may be a sign of strength — not weakness — as the market seeks its next sustainable move.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.