The BitMEX co-founder’s endorsement adds fuel to Zcash’s explosive rally, which has surged over 400% in the past month amid renewed demand for privacy-focused cryptocurrencies.

Hayes Backs Zcash After 400% Price Surge

Arthur Hayes, co-founder of crypto derivatives giant BitMEX, revealed that Zcash (ZEC) has become the second-largest holding in his family office MaelstromFund, surpassed only by Bitcoin (BTC).

“Due to the rapid ascent in price, ZEC is now the 2nd largest LIQUID holding in MaelstromFund portfolio behind BTC,” Hayes wrote in an X post on Friday.

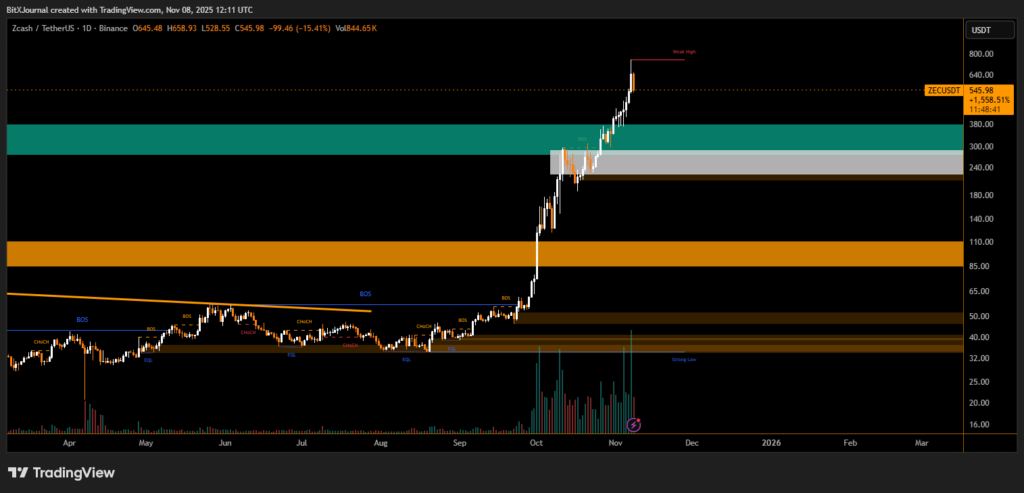

The disclosure comes as ZEC skyrocketed from $137 to above $730 over the past month — a surge of more than 400% — before settling around $548 at the time of writing.

Privacy Coins Lead the Market

Zcash’s rally mirrors a broader upswing in privacy-oriented cryptocurrencies, as traders bet on coins offering stronger anonymity features. Other notable gainers include:

- Dash (DASH) — up over 100%,

- Decred (DCR) — up more than 100%, and

- ZKsync (ZK) — also doubling in value.

Meanwhile, major assets like Bitcoin ($101,965) and Ether ($3,350) have remained range-bound, reflecting broader market uncertainty.

Zcash Market Snapshot

According to BITXjournal, ZEC’s:

- Price: $548 (down ~12% in 24h)

- Market Cap: $8.9 billion

- Trading Volume: up 139% to $4.63 billion

- Circulating Supply: 16.28 million ZEC (max supply: 21 million)

- Fully Diluted Valuation (FDV): $11.5 billion

Zcash’s hybrid model — supporting both transparent and shielded transactions — has been cited as a key driver of renewed institutional interest. Like Bitcoin, Zcash uses proof-of-work (PoW) consensus and a fixed supply, adding a sense of scarcity that appeals to long-term holders.

Privacy Narrative Powers ZEC’s Comeback

According to Alex Bornstein, executive director of the Zcash Foundation, the cryptocurrency’s resurgence is “entirely organic,” fueled by growing public concern over digital surveillance and financial privacy.

“We were surprised to see when these mentions started popping up,” Bornstein said on Cointelegraph’s Chain Reaction. “Then to see that kind of wave just start to spread and then crest was extraordinary.”

He emphasized that the Zcash Foundation had “absolutely nothing to do” with the surge, framing it as a grassroots movement for financial autonomy in a world of increasing data control.

With Arthur Hayes’ public endorsement and a rising global narrative around privacy, Zcash’s comeback marks one of 2025’s most dramatic crypto turnarounds. As regulatory scrutiny on blockchain transparency tightens, privacy coins like ZEC could continue to capture both investor interest and policy attention in the months ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.