Volume recovery and trendline resistance test hint at a short-term bullish shift.

Shiba Inu (SHIB) surged 5% on Friday to trade around $0.00001008, rebounding from multi-week lows amid renewed buying interest across major altcoins. The move followed a sharp uptick in trading volume exceeding 870 billion tokens, signaling a potential stabilization phase after an extended period of selling pressure.

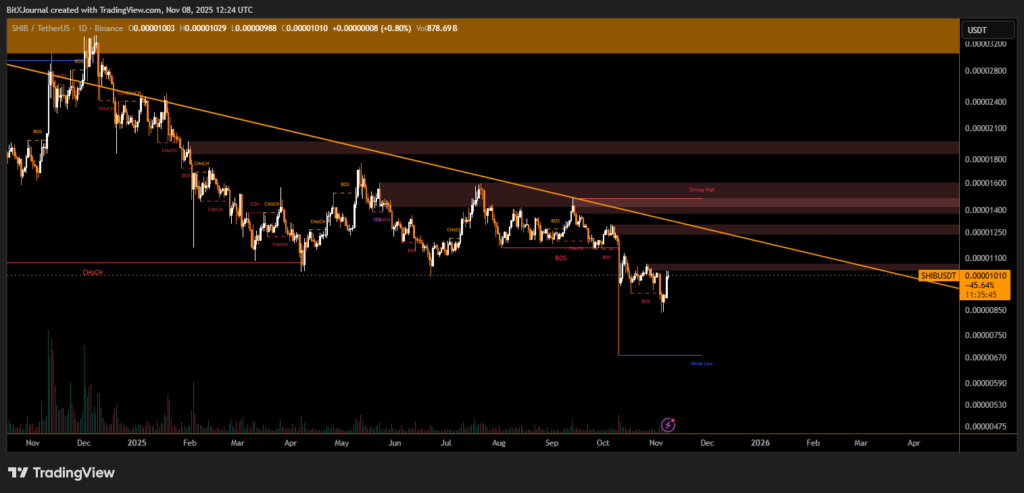

On the daily chart, SHIB continues to trade within a descending trendline that has capped price action since early March. The latest rebound occurred near a weak low zone around $0.0000090, where buyers stepped in to defend support levels that have previously triggered accumulation.

Technical indicators point to a possible short-term reversal as momentum shifts away from extreme oversold conditions. The break of structure (BOS) seen earlier this week indicates an attempt to establish a higher low, which could set the stage for a gradual recovery.

BitXJournal crypto market analyst commented, “Shiba Inu’s current price structure suggests a technical bottoming process. Sustaining above $0.0000100 could open the way toward the $0.0000115–$0.0000120 resistance area, but a rejection at the trendline may limit upside potential.”

Support and Resistance Levels

Immediate support remains at $0.0000090, a level reinforced by previous liquidity sweeps and institutional buying footprints. On the upside, the first resistance zone lies between $0.0000115 and $0.0000128, while stronger selling interest is expected near the descending trendline around $0.0000135.

A confirmed daily close above this region would invalidate the current downtrend and potentially shift market sentiment in favor of bulls. Until then, SHIB remains within a broader bearish-to-neutral structure, with price compressing beneath key supply areas.

Volume and Market Sentiment

Trading activity has been increasing steadily, reflecting cautious optimism among traders betting on a short-term bounce. Despite lingering bearish overtones in the broader market, analysts note that meme tokens like SHIB often outperform in early stages of recovery phases due to speculative inflows.

If Shiba Inu maintains momentum above $0.0000100, technical projections point toward a retest of $0.0000120 in the coming sessions. However, failure to break past the descending trendline could trigger another correction toward $0.0000090, keeping SHIB range-bound until stronger bullish confirmation emerges.

In summary, Shiba Inu’s 5% rally highlights renewed buyer confidence at key support levels, though the token must clear multiple resistance zones to confirm a sustainable recovery trend.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.