Despite losing momentum to sectors like AI and gold, analysts believe Bitcoin’s cooling phase marks a healthy transition toward long-term maturity and renewed investor focus.

After a blazing start to 2025, Bitcoin’s momentum has cooled, with investors rotating toward AI, quantum tech, nuclear energy, and gold. Yet according to Alex Thorn, head of research at Galaxy Digital, this slowdown is part of a natural market evolution — not a decline. “Attention will come back to Bitcoin, it always does,” he told CNBC, describing the current phase as a “much more mature era” for the world’s largest cryptocurrency.

From Hottest Trade to Quiet Consolidation

At the start of the year, Bitcoin was the market’s hottest trade, rallying sharply after Donald Trump’s presidential victory reignited optimism around pro-crypto policies. However, enthusiasm faded as traders pursued gains in other high-growth sectors.

“There were a lot of other places to get gains this year that impeded allocation to Bitcoin,” Thorn said, referencing investor shifts toward AI innovation, renewable energy projects, and gold.

Even so, he views the current cycle as “healthy redistribution”, where long-term holders gradually transfer coins to new investors — broadening ownership and strengthening Bitcoin’s market foundation.

Revised Targets Reflect Realism, Not Weakness

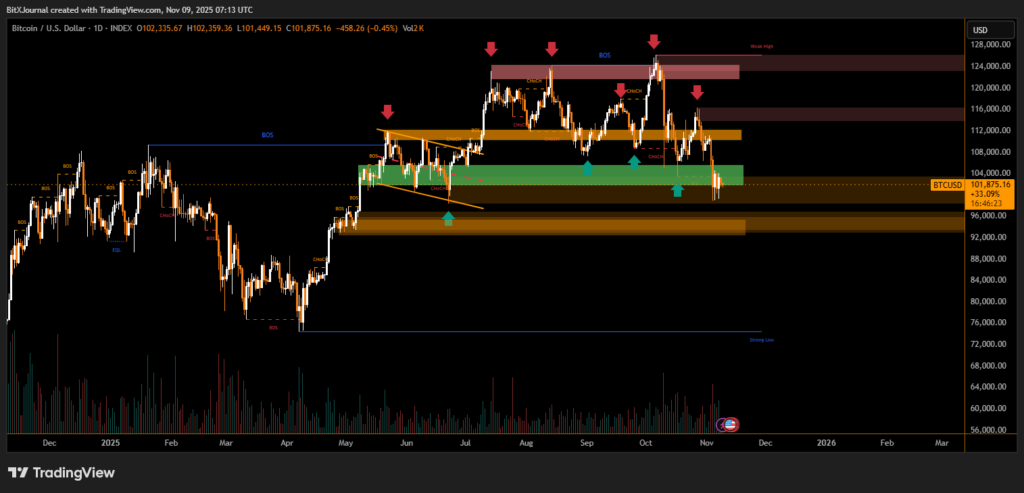

While maintaining a bullish long-term outlook, Galaxy Digital has trimmed its year-end Bitcoin target from $185,000 to $120,000 — still implying a 17% upside from the current level of around $102,000. Thorn emphasized that Bitcoin’s structural growth story remains intact, even if short-term enthusiasm has cooled.

“We’re seeing normalization, not decline,” one analyst noted. “The focus is shifting from speculation to sustainability — a sign of a maturing digital asset class.”

Macro Shifts and Market Comparisons

Bitcoin’s 15% drop over the past month coincides with a broader rotation toward traditional safe havens. Interestingly, JPMorgan analysts recently observed that rising gold volatility has made Bitcoin comparatively less risky, with the BTC-to-gold volatility ratio falling to 1.8, signaling a narrowing risk gap.

At the same time, correlations between Bitcoin and AI-related equities such as Nvidia have tightened — prompting some concerns of an “AI bubble” reminiscent of the late-1990s tech boom.

The debate over quantum computing’s potential threat to Bitcoin remains unresolved. Some experts downplay the risk as “years away,” while others warn the industry must act now to future-proof the network.

Still, Thorn and other strategists believe Bitcoin’s current lull is only temporary. As liquidity cycles shift and speculative sectors cool, capital and attention are expected to flow back into digital assets.

“Bitcoin always finds its moment again,” Thorn concluded — and this time, it may do so as a more mature, globally integrated asset than ever before.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.