The first week of November delivered a mixed backdrop for both cryptocurrency and traditional financial markets. Major tokens such as Bitcoin, Ethereum, and select altcoins faced renewed headwinds, even as safe-haven play in gold held firm. Across the board, a rotation of capital away from highly speculative assets into perceived stability defined trading behaviour.

Broader Market Landscape

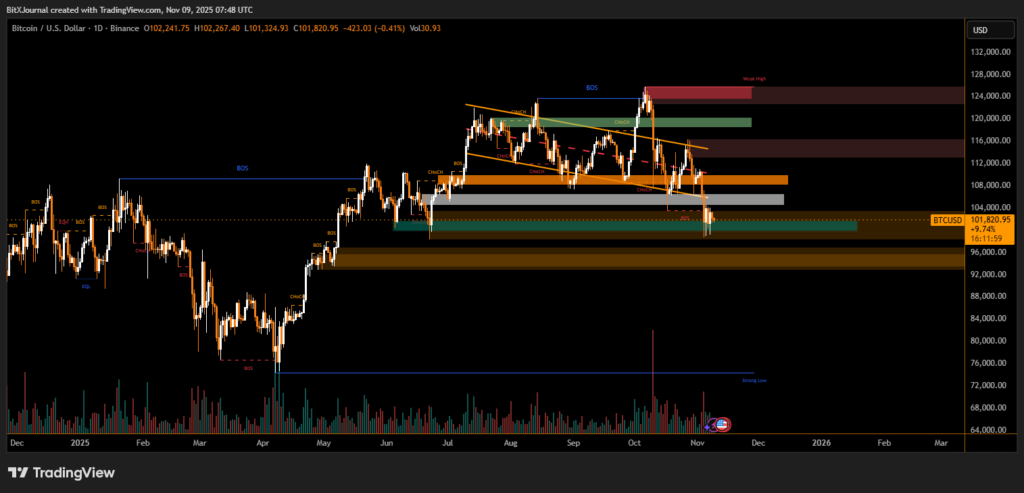

Spot gold settled at around $4,001 per ounce on 7 November, supporting the view that investors continue to allocate into non-yielding assets amidst global uncertainty. At the same time, Bitcoin hovered near $101,000–$103,000, after falling from recent highs. Historical data show a close on 8 November near $101,838, suggesting a pause in upside momentum. Inflation concerns, central-bank rhetoric, and regulatory shifts in crypto-space combined to dampen speculative capital flows.

Bitcoin & Ethereum: Tech-Driven Pressure

Bitcoin’s inability to reclaim six-figures convincingly stands out. On 4 November, it traded near $106,500 before rolling back, and by 8 November was closer to $101,800. BitXJournal analyst noted that “holding above the $100k threshold is crucial for Bitcoin to avoid a deeper correction.” Ethereum likewise lacked follow-through, with upside enthusiasm muted amid risk-averse sentiment. The crowd appears to be waiting for a catalyst rather than initiating fresh entries.

Altcoin Spotlight: DOGE, XRP, ICP & ZEC

- Dogecoin (DOGE) slid more than 10% from its early‐week levels, reflecting waning participation. The token’s weakness underscores how altcoins are increasingly tied to Bitcoin’s path.

- XRP remained trapped in a $2.30–$2.70 range, unable to break higher under the current backdrop.

- Internet Computer (ICP) held up relatively better than many peers, but broad sector weakness limited its upside.

- Zcash (ZEC) offered one of the few bright spots, posting gains in a week where many tokens declined, although volatility remains elevated.

The market currently reflects a “risk-off but not panic” environment. Critical levels to watch: Bitcoin must firm above ~$100k to prevent broader breakdowns; gold must defend ~$3,950–$3,800 to maintain its haven narrative. For altcoins, only tokens showing relative strength—and anchoring to clean price structure like ICP and ZEC—look poised to outperform if sentiment normalises.

Meanwhile, macro forces remain big drivers: upcoming inflation data, central-bank commentary and regulatory signals within crypto are likely to spark directional moves rather than idle noise. In short: markets are in a pause mode, waiting for the next catalyst.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.