XRP Price Analysis: Key Support Tested After Sharp Decline

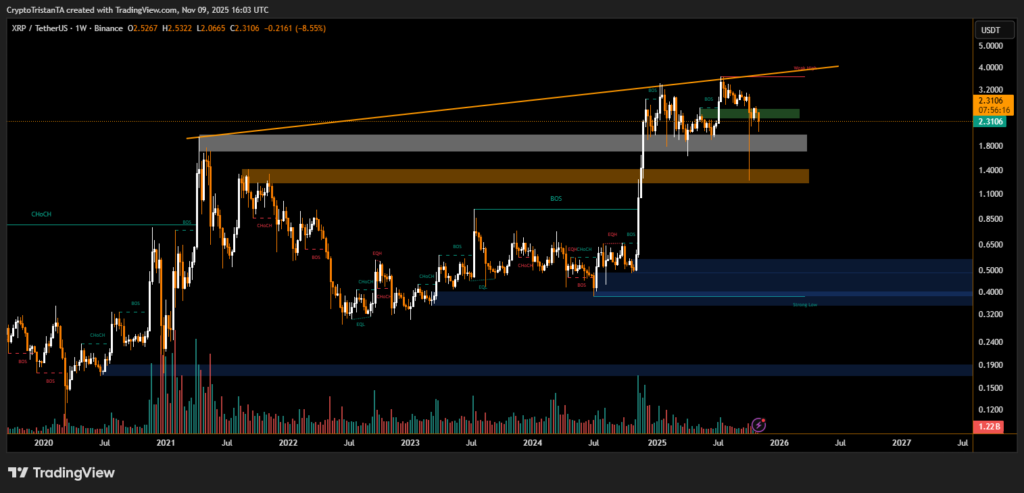

XRP recorded a weekly decline of over 8%, slipping to around $2.31 after facing strong rejection from its long-term resistance trendline near the $2.53–$2.60 zone. The chart indicates that the asset remains in a corrective phase following its previous breakout attempt, with traders closely watching whether buyers can defend the $2.10–$2.00 support range to prevent deeper losses.

After several weeks of consolidation, XRP’s momentum turned negative as sellers reemerged near major resistance. The weekly chart shows a clear rejection from a rising trendline that has capped gains since mid-2024. This reversal suggests that profit-taking and renewed market caution are weighing on the asset’s near-term trajectory.

Volume has also expanded alongside the pullback — a sign that institutional participants are likely rebalancing positions ahead of broader crypto market data releases.

On the technical front, XRP remains within a broad ascending structure, but the latest failure to hold above $2.50 exposes it to further correction. The chart highlights several key demand zones — with immediate support near $2.10, followed by a deeper base around $1.85–$1.70, where strong buying activity has historically emerged.

BitXJournal Analysts note that the break of short-term bullish structure could signal the start of a new retracement phase. However, if XRP stabilizes above $2.10 and resumes higher, the next resistance to watch lies near $2.80–$3.00. Sustained movement above that range could reignite momentum toward $3.40–$3.60 in the coming months. BitXJournal market strategist explained that “the current rejection doesn’t invalidate XRP’s long-term bullish bias, but it reinforces the need for a base to form before any next major leg higher.”

Investor Sentiment and Outlook

Broader crypto sentiment has softened amid mixed macroeconomic signals and volatility in Bitcoin and Ethereum. Many traders are opting for defensive positions until clear confirmation of strength returns. Still, XRP’s higher-timeframe structure remains constructive, provided it avoids a weekly close below $2.00.

As the week concludes, all eyes are on whether buyers can hold the mid-$2 range and rebuild momentum. A decisive reclaim above $2.50 could reestablish bullish control, while failure to defend $2.00 may invite deeper consolidation toward $1.70.

In summary, XRP enters the new week at a critical crossroads — testing both its resilience and investors’ conviction in a maturing uptrend.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.