After a rapid surge that pushed prices above key resistance levels, Internet Computer (ICP) shows early signs of consolidation amid heavy profit-taking.

The Internet Computer (ICP) token has entered a retracement phase following a powerful breakout that saw prices rise sharply from below $3 to above $10 in just a few trading sessions. According to recent TradingView data, the move was driven by aggressive buying pressure that broke through multiple resistance zones, but technical indicators now suggest a potential short-term correction.

ICP Price Action and Technical Structure

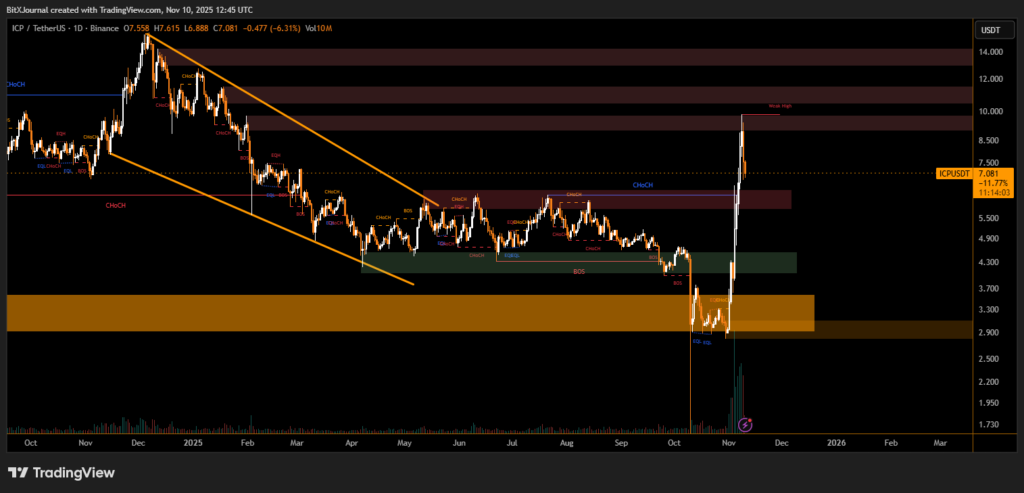

The daily chart shows ICP initially breaking out from a descending wedge pattern, a structure often associated with trend reversals. The breakout led to a rapid change of character (CHoCH) and break of structure (BOS) confirmations, sending the token into a parabolic rise.

However, after touching the $10.00 region — marked as a “weak high” zone — ICP began to pull back, now trading near $7.26, down over 9% in the last 24 hours. Analysts note that the retracement appears natural after such a steep rally.

“When a breakout extends vertically with limited volume confirmation at higher levels, retracement is expected as traders lock in profits,” said BitXJournal technical analyst monitoring the move.

Key support zones are visible around $4.90 and $3.00, areas highlighted by previous BOS and equal low (EQL) levels. Maintaining support above $6.80 could preserve the bullish structure, but a deeper correction toward $4.50 cannot be ruled out if momentum weakens.

Volume analysis indicates declining buy-side activity after the breakout, suggesting that short-term traders may be exiting positions. RSI and momentum oscillators are also cooling, reinforcing the case for a brief consolidation phase before any renewed push higher.

Despite the current pullback, long-term sentiment around ICP remains cautiously optimistic. The breakout from a year-long downtrend signals potential for broader upside if the asset holds key mid-range supports.

Technical analysts emphasize that retracements following vertical rallies often create healthier market structures, offering potential re-entry zones for swing traders.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.