Spot silver surges above $50 per ounce, breaking key resistance levels as traders eye fresh highs after weeks of consolidation.

Silver prices saw a strong rebound on Monday, rising nearly 4% intraday to trade around $50.07 per ounce, marking one of the metal’s most aggressive daily moves in weeks. The rally comes as renewed momentum in commodities and improving technical signals push spot silver up 3.62%, positioning the metal for a potential retest of its recent swing high near $52.

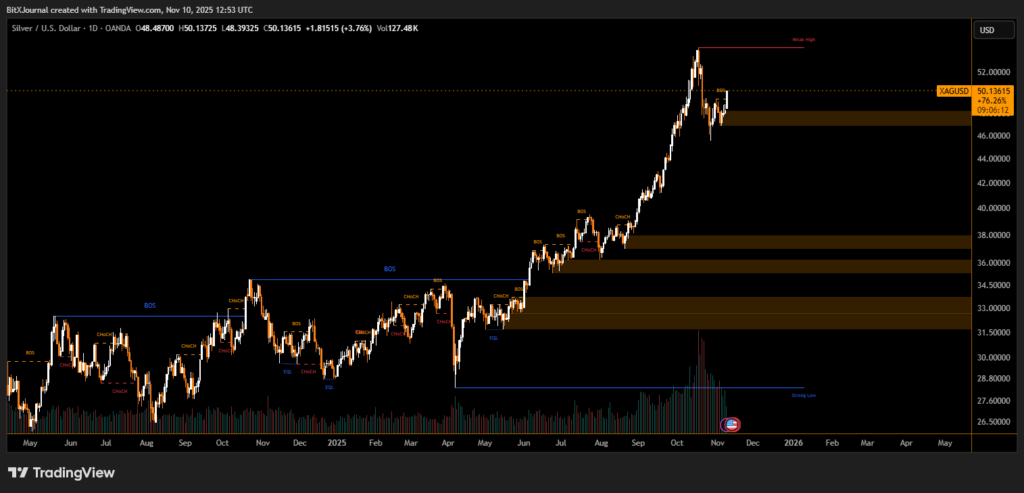

From a technical standpoint, silver has confirmed a bullish structure, breaking above a short-term consolidation zone and reclaiming support around $48.50–$49.00. The move follows a series of break-of-structure (BOS) patterns seen since mid-October, signaling that the market’s upward momentum remains intact.

“The $50 mark is psychologically important,” said BitXJournal commodities strategist. “Holding this level could set the stage for silver to revisit $52 and potentially challenge new yearly highs if buying volume continues.”

Volume data shows a noticeable uptick during the breakout, with trading activity concentrated near recent demand zones. Analysts note that buyers have consistently defended the $46–$47 range, an area now serving as a strong accumulation base.

BitXJournal market analyst added, “Silver’s technical picture looks constructive. The key now is whether price can sustain above $49.80 on daily closes — that would confirm a continuation pattern toward $52–$54 per ounce.”

If silver maintains its current pace, it may extend its rally toward the upper resistance zone marked by the previous “weak high” on charts. However, a failure to hold above $49.50 could trigger a short-term pullback, with potential downside support found near $46.30.

With the precious metals market gaining traction amid broader risk adjustments, silver’s latest surge highlights renewed investor appetite for tangible assets. The break above $50 has strengthened the bullish case, and technical indicators suggest momentum could persist if price consolidates above key support zones in the coming sessions.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.