Technical indicators suggest a potential bullish reversal as Bitcoin rebounds from critical demand zones.

Bitcoin’s price action is showing renewed strength this week, testing the $107,000 resistance zone after bouncing from a significant demand block near $100,000. The rebound comes amid heightened trading activity and growing optimism that the market may be setting up for a major trend reversal.

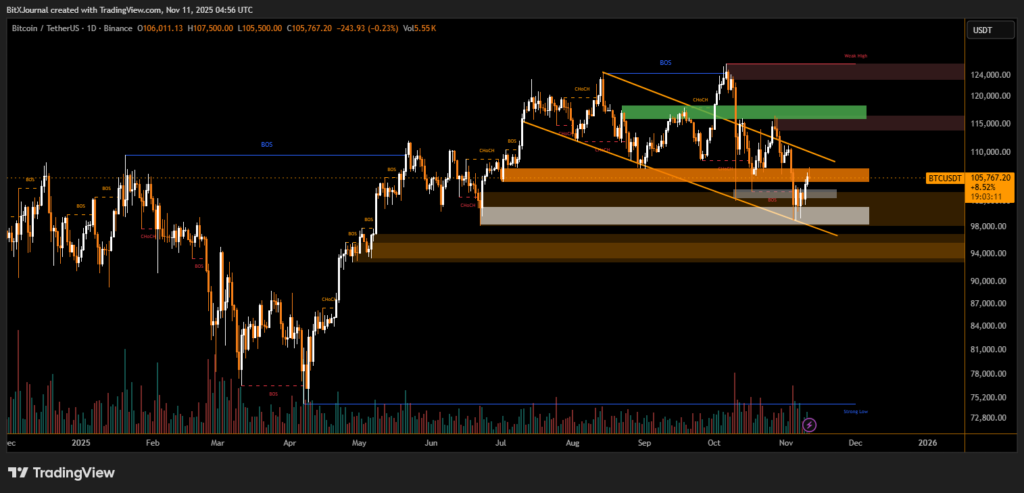

On the daily chart, Bitcoin recently broke out of a descending channel, with price reclaiming a previous structure break (BOS) area — a move many traders view as an early sign of bullish intent. The recovery above the $105,000 support region marks a critical inflection point that could determine the market’s next macro move.

BitXJournal Technical analysts are watching the $107,000–$110,000 range, which aligns with a confluence of supply zones and previous liquidity clusters. A successful daily close above this zone could open the path toward $115,000, where a key imbalance zone remains unfilled.

“The recent bounce from the $99K–$101K region shows strong buyer interest at institutional levels. If Bitcoin can hold above $105K, momentum could shift decisively bullish in the short term,” said BitXJournal senior market strategist.

However, the weak high around $124,000 remains a longer-term target, signaling where liquidity may rest above the current structure. Until that level is taken, analysts caution that volatility may persist, especially as Bitcoin continues to retest resistance along the trendline.

Volume data also supports this view, showing rising participation on bullish candles, an early indication that demand could be returning after weeks of consolidation.

If Bitcoin closes above the $107K level with strong volume, the breakout could confirm a structural shift — turning the previous resistance into new support and setting the stage for another leg toward the mid-$110K region.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.