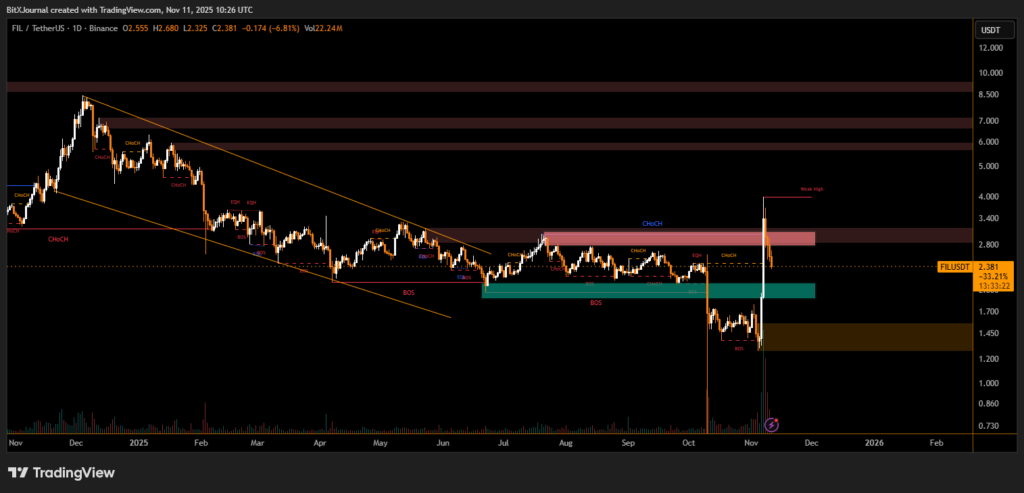

Filecoin Price Analysis

Filecoin (FIL) extended its decline this week, falling over 33% to trade near $2.38 after failing to sustain momentum above the $2.80 resistance zone. The sharp drop came amid a notable surge in trading activity, with volume spiking 137% above average, reflecting heavy selling pressure and potential liquidation flows across exchanges.

The latest rejection marked a turning point for FIL, which briefly rallied toward $3.40 before facing strong resistance near the upper liquidity cluster. The price action shows a clear change of character (CHoCH) pattern, confirming a bearish reversal after multiple failed attempts to reclaim the upper structure.

Technical Breakdown and Key Zones

On the daily chart, FIL broke decisively below the $2.60 support level, triggering a cascade of sell orders as traders exited long positions. The next immediate support lies near $2.10–$2.00, aligned with the green demand zone highlighted in previous sessions. A sustained breach below this area could open the path toward the $1.40–$1.50 range, where historical accumulation previously occurred.

BitXJournal market strategist observed, “The breakdown beneath $2.60 confirms structural weakness. The high-volume move suggests capitulation, but unless FIL quickly reclaims $2.80, the probability of continued downside remains high.”

Indicators confirm this bearish tilt — momentum oscillators have turned negative, and the relative strength index (RSI) is nearing oversold conditions. However, analysts caution that oversold readings in declining markets often precede prolonged consolidation rather than an immediate reversal.

Market Context and Outlook

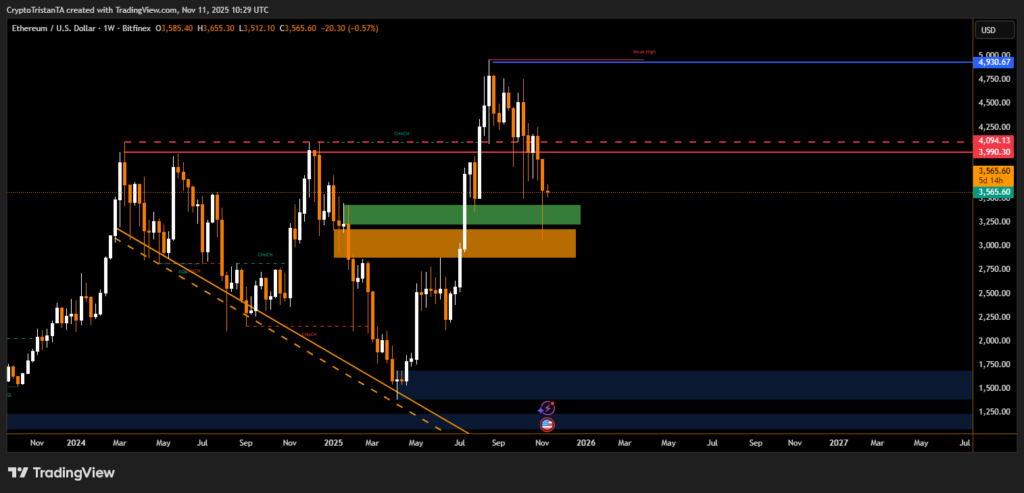

The broader crypto market remains mixed, with Ethereum holding near $3,600, while several altcoins experience sector-specific corrections. Filecoin’s weakness appears more technical than fundamental, as traders rotate toward stronger-performing tokens in the DeFi and data storage niches.

Should buying pressure reemerge around the $2.00 handle, a short-term rebound toward $2.60 may occur, but the larger structure remains bearish below $3.00.

As BitXJournal analyst summarized, “FIL needs a clean break and daily close above $3.00 to restore bullish confidence. Until then, traders should treat rallies as potential relief bounces rather than trend reversals.”

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.