SOL Funds Attract $342 Million Since Launch, Supporting Altcoin Market

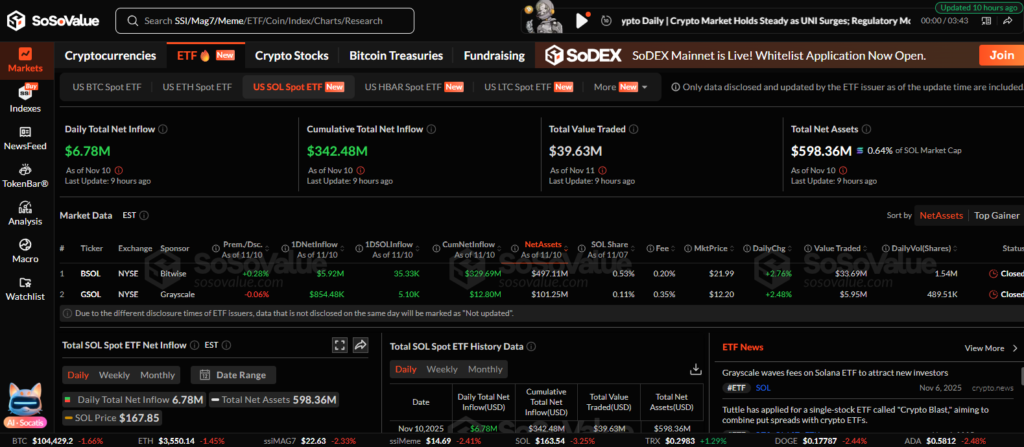

U.S. spot Solana ETFs have reported their 10th consecutive day of net inflows, signaling sustained investor appetite for Solana exposure despite broader crypto volatility. On Monday, the funds collectively saw $6.78 million in net inflows, led by Bitwise’s BSOL with $5.92 million, while Grayscale’s GSOL added $854,480.

Continued Positive Momentum

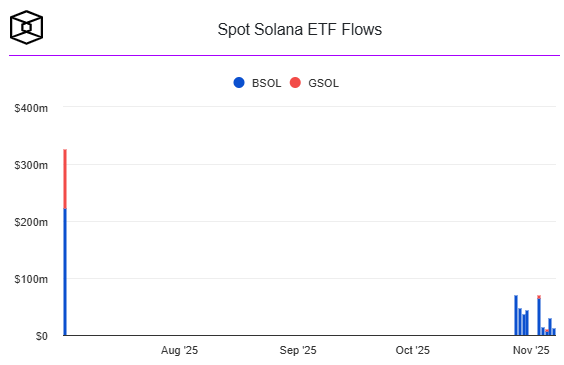

Since the launch of BSOL on October 28, the two Solana ETFs have accumulated a total of $342.48 million in net inflows. Except for two days with no activity from GSOL, the funds have maintained a consistent positive inflow trajectory.

Although Monday’s inflow represented the lowest daily figure since debut, analysts view the trend as a strong signal of institutional adoption.

“The U.S. spot Solana ETF inflow streak significantly outperformed pre-launch expectations that projected less institutional uptake due to Solana’s perceived regulatory and technical risks,” said Nick Ruck, director at LVRG Research.

Institutional Appeal of Solana ETFs

Early inflows exceeded $70 million on high-volume days, attracting attention from market watchers. Bloomberg Senior ETF Analyst Eric Balchunas described the performance as a “huge number, good sign” for Solana’s ecosystem.

Ruck noted that investors are treating Solana ETFs as high-beta complements to BTC and ETH ETFs, seeking diversified exposure while accepting higher volatility for potentially stronger risk-adjusted returns.

“Sustained ETF inflows should provide durable price support for SOL by tightening supply dynamics and drawing institutional capital,” Ruck added.

Despite inflows, Solana prices fell 1.85% in the past 24 hours to $164.24, reflecting short-term market fluctuations. Meanwhile, spot Bitcoin ETFs added $1.15 million, Ethereum ETFs saw no flows, and Litecoin ETFs recorded $2.11 million in inflows.

Analysts suggest that continuous institutional participation through spot ETFs may help stabilize Solana’s market supply, offering longer-term support for SOL as adoption of altcoins broadens within institutional portfolios.

The 10-day inflow streak underscores growing confidence in Solana ETFs as a tool for both portfolio diversification and targeted exposure to the Solana blockchain ecosystem.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.