Bitfinex Warns of Consolidation Phase; Analysts Split on Whether BTC Can Revive November’s Bullish Streak

Bitcoin’s famed “Moonvember” rally may be on hold this year as macroeconomic uncertainty clouds investor sentiment. Analysts at Bitfinex predict that Bitcoin (BTC) will likely trade sideways through November, breaking from its historical pattern of strong monthly gains.

Macro Pressure Weighs on Bitcoin

“The current macro backdrop — easing policy but mixed communication from the Fed — supports consolidation as a necessary stabilizing phase before volatility can expand again,” Bitfinex analysts wrote in a Nov. 12 markets report.

Federal Reserve Chair Jerome Powell recently hinted at uncertainty regarding a 25-basis-point rate cut at the Fed’s Dec. 10 meeting, tempering investor enthusiasm.

According to the CME FedWatch Tool, the odds of a rate cut now stand at 67.9%, down from over 90% in recent months. Since lower rates generally drive capital toward risk assets like crypto, hesitation from the Fed could slow Bitcoin’s momentum.

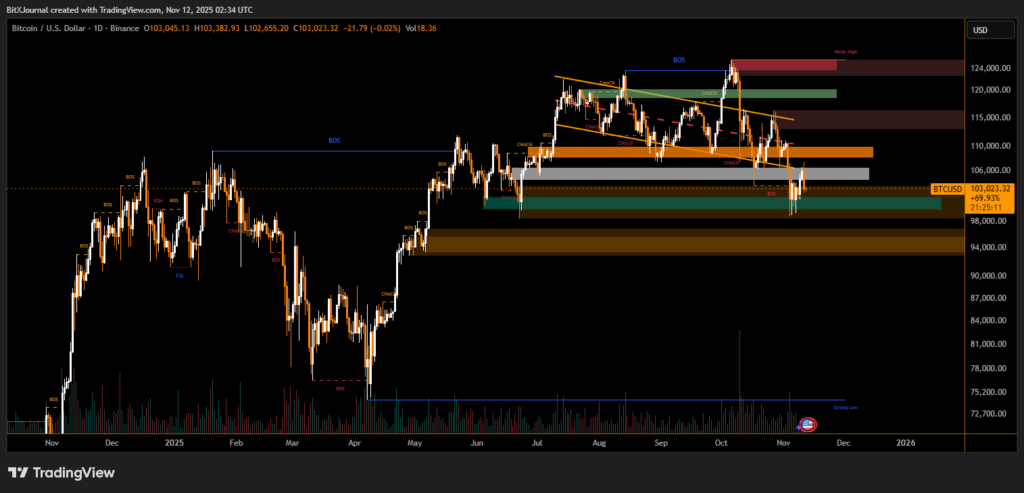

Bulls Lose Steam Around $116K

Bitcoin has fallen 11.09% over the past 30 days, currently trading near $103,000, according to CoinMarketCap. Bitfinex analysts warned that bullish conviction is fading as long-term holders begin to offload their positions.

“Unless the price recovers decisively above this range, time becomes a growing headwind for bulls,” the analysts said, noting that investors may grow impatient if BTC fails to reclaim the $116,000 level soon.

Historical Patterns Offer Hope

Despite the cautious outlook, several analysts remain optimistic that November could still turn positive. Data from CoinGlass shows that since 2013, Bitcoin has averaged a 41.78% gain in November, making it historically the cryptocurrency’s strongest month.

Crypto trader Dave Weisberger believes fundamentals remain intact.

“Context is very constructive relative to previous cycles, and we are at the bottom, not the top of the range, relative to other financial assets,” Weisberger said.

Similarly, Carl Runefelt wrote on X (formerly Twitter) that “November will turn green again for Bitcoin soon — those big green candles are coming.” Trader AshCrypto echoed the sentiment, saying he remains “still bullish.”

A Battle Between History and Headwinds

Bitcoin reached an all-time high of $125,100 in early October, but has struggled to regain momentum following the Oct. 10 market crash, which erased roughly $19 billion in leveraged positions.

As traders debate whether Bitcoin will extend its bullish seasonal trend or stay range-bound, the coming weeks could determine whether “Moonvember” lives up to its name — or fades into “Midvember” consolidation instead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.