Digital asset treasury strategy boosts revenue and transforms Solana holdings into high-yield assets.

Upexi, the Solana-focused digital asset treasury and consumer brands company, posted a record quarter with $9.2 million in total revenue, more than double last year’s $4.4 million. The surge was driven primarily by $6.1 million in digital asset revenue, including staking income, highlighting the growing impact of blockchain-based treasury strategies on corporate balance sheets.

Revenue Growth and Net Income Surge

The Nasdaq-listed firm reported net income of $66.7 million, or $1.21 per share, compared to a net loss of $1.6 million during the same quarter last year. This dramatic turnaround was largely attributed to $78 million in unrealized gains from its Solana holdings, underlining the profitability of directly holding cryptocurrency as part of corporate treasury management.

CEO Allan Marshall explained, “Early in 2025, we enhanced our cash management and treasury strategy to include holding Solana directly on our balance sheet. Today, substantially all our Solana is generating meaningful yield, effectively turning our treasury into a productive, revenue-generating asset.“

Strategic Investments and Solana Treasury Expansion

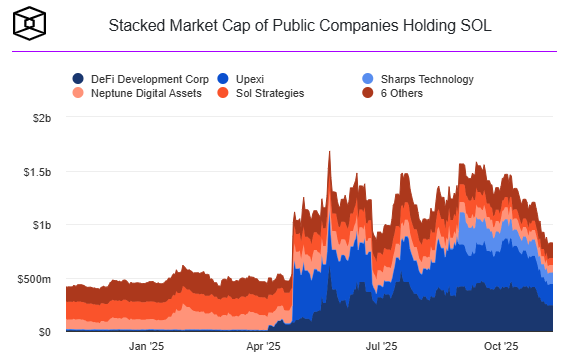

During the quarter, Upexi completed a $200 million private placement of common stock and convertible notes, alongside a $500 million equity line agreement to accelerate growth in its Solana treasury strategy. Following its latest purchase, the company now holds over 2.1 million SOL, making it the second-largest Solana treasury behind DeFi Development Corp.

The firm has also integrated prominent advisors, including Arthur Hayes and SOL Big Brain, to strengthen its strategy in digital asset management and staking. Marshall emphasized, “We are in an advantaged position to win, underpinned by an end-game asset with nearly unlimited upside, offering additional value accrual through staking and discounted locked tokens.“

Market Reaction and Outlook

Shares of Upexi (UPXI) rose about 6% in after-hours trading to $3.21, reflecting investor confidence in the company’s Solana-focused treasury approach. Despite broader market fluctuations, Upexi’s strategy demonstrates how institutional digital asset treasuries can deliver substantial revenue and long-term value creation.

Upexi’s record quarter underscores the growing potential of Solana-based corporate treasuries. By combining direct cryptocurrency holdings with innovative staking strategies, companies can transform traditional cash management into a high-yield, blockchain-driven financial model, setting a benchmark for the future of institutional digital asset adoption.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.