Move reignites debate over privacy, self-custody, and the role of centralized platforms in the crypto ecosystem

Zcash back in focus as Hayes calls for self-custody

The privacy coin sector has returned to the spotlight after Arthur Hayes, co-founder of BitMEX, urged Zcash (ZEC) holders to withdraw their assets from centralized exchanges (CEXs) and move them to self-custodial wallets.

In a post on X (formerly Twitter), Hayes wrote, “If you hold $ZEC on a CEX, withdraw it to a self-custodial wallet and shield it.” His statement refers to Zcash’s “shielded” feature, which allows users to conduct private, zero-knowledge transactions — obscuring sender, receiver, and amount details.

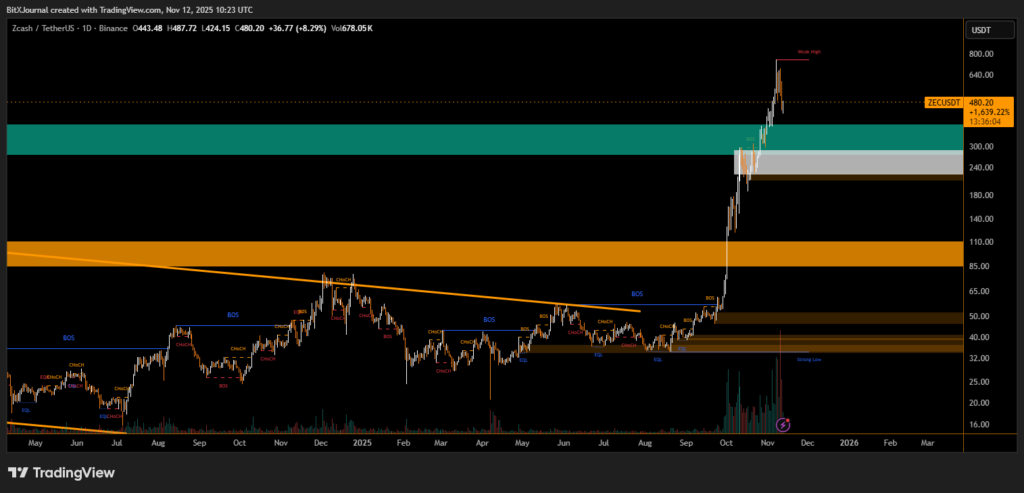

The call came amid heightened volatility in Zcash’s price. Over the past week, ZEC surged to $723 before plunging to $450, a 37% drop from its recent high. Analysts attribute the swings to overbought technical conditions, as the token’s Relative Strength Index (RSI) reached its highest level in months.

Why Zcash holders are told to “shield” their tokens

Zcash operates with two address types — transparent (t-addresses) and shielded (z-addresses). While t-addresses function like standard public blockchain wallets, z-addresses use zk-SNARKs (zero-knowledge proofs) to preserve privacy.

Most centralized exchanges only support t-addresses, meaning transactions made through CEXs are fully traceable. As a result, holding ZEC on an exchange defeats its core privacy purpose.

By urging holders to “shield” their coins, Hayes highlighted a long-standing concern among privacy advocates — that exchange custody undermines user anonymity and exposes assets to withdrawal freezes, Know Your Customer (KYC) restrictions, and potential delistings, similar to what Monero (XMR) experienced in recent years.

“If your coins stay on an exchange, your privacy doesn’t,” a blockchain security analyst noted. “Self-custody ensures true ownership and resilience against centralized risks.”

Privacy coins show mixed market performance

Despite its sharp decline, Zcash still commands a market capitalization of $7.4 billion, up 5% over the past week, according to CoinMarketCap data. Monero (XMR) also remains strong, rising 7% during the same period to a $7 billion valuation.

However, other privacy tokens, including Canton (CC), Dash (DASH), Decred (DCR), and ZKsync (ZK), have suffered double-digit losses, dropping between 13% and 42%.

Balancing privacy and responsibility

Hayes’s comments underscore a deeper philosophical divide in crypto: the tension between convenience and sovereignty. While centralized exchanges offer ease of use, self-custody provides control and censorship resistance — at the cost of greater personal responsibility.

As privacy coins face renewed scrutiny and regulation, Hayes’s call reflects a growing sentiment among crypto veterans: true privacy and autonomy can only exist off-exchange, in the hands of users themselves.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.