Crypto Market Weakens as LINK Faces Selling Pressure Near $16.25

Chainlink’s native token LINK fell nearly 4% on Thursday, trading around $15.82, as renewed market optimism following ETF-related headlines failed to translate into sustained buying momentum. The token encountered strong resistance near $16.25, a level that has repeatedly capped upward moves over the past week, aligning with a broader decline across major digital assets.

Technical Outlook Points to Neutral-to-Bearish Momentum

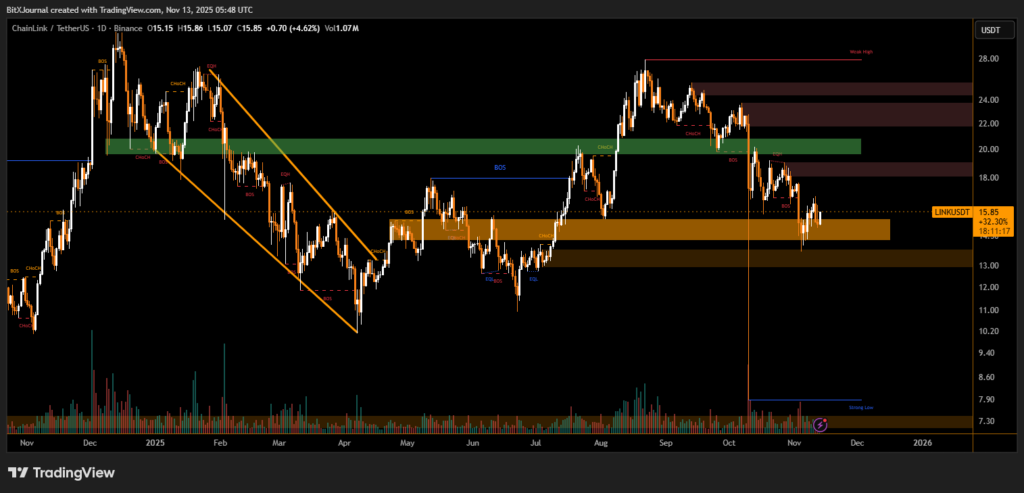

According to data from the daily LINK/USDT chart, price action shows a Break of Structure (BOS) below the $16 handle earlier this week, followed by a rejection from the supply zone between $16.20 and $17.00. This technical configuration signals continued selling pressure and uncertainty among short-term traders.

“The market clearly respected the $16.25 rejection area,” said BitXJournal market analyst. “Unless LINK can close decisively above $17, we’re likely to see a retest of the $14.80–$14.20 demand zone, which aligns with previous accumulation levels.”

Volume analysis indicates that trading activity has been gradually declining since early November, hinting at fading momentum despite the recent ETF speculation that initially lifted sentiment.

ETF Narrative Sparks Brief Interest but Lacks Follow-Through

While early reports about a potential Chainlink-based exchange-traded fund generated short-lived enthusiasm, institutional participation appears limited. Traders remain cautious amid mixed macroeconomic signals and a cooling in broader crypto market enthusiasm.

“ETF-related excitement can provide a short-term spark,” BitXJournal crypto strategist noted, “but without consistent liquidity inflows or confirmation from regulators, such rallies often lose traction quickly.”

Key Levels and Market Outlook

Analysts are now watching the $15.00 support as a crucial line in the sand. A breakdown could expose further downside toward $13.50, where historical buy interest reemerges. On the upside, sustained closes above $17.00 could open a path toward the next major resistance at $20.00.

Chainlink’s price behavior reflects a cautious market — supported by long-term fundamentals but weighed down by short-term technical resistance and tepid investor sentiment.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.