Internet Computer maintains a tight trading structure after a failed breakout, with buyers and sellers balancing around major technical levels.

Internet Computer (ICP) is trading steadily near the $6.00 mark after an early-November spike failed to secure enough momentum to break above the $6.66 resistance zone. The token now moves within a narrow consolidation range, supported by moderate trading volume and a clearly defined technical structure. Market analysts say the latest price action reflects a “controlled cooldown” rather than a shift back into broader weakness.

Technical Landscape and Market Structure:

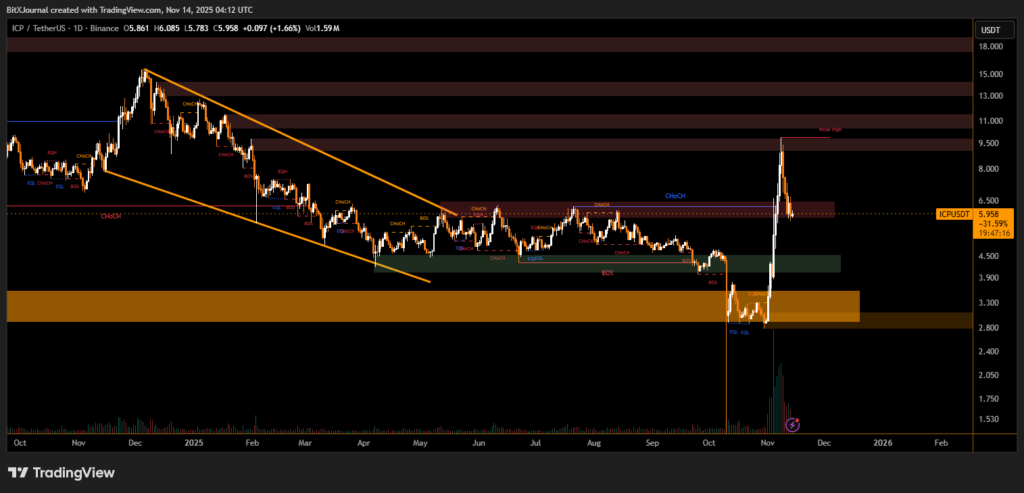

Price action over the past several weeks shows ICP rejecting sharply from the $6.66 resistance, a level reinforced by a deep red supply zone visible on the daily chart. The attempted breakout drew significant volume but ultimately stalled as sellers defended prior imbalances.

The chart also highlights a strong demand region around $3.00–$3.40, which produced the explosive rally that propelled the token back above the $5.50 handle. Since then, ICP has created a series of change-of-character (CHoCH) and break-of-structure (BOS) signals, marking a shift from long-term downtrend conditions into a more neutral range-bound environment.

BitXJournal technical analyst observing the consolidation noted, “This range between $6.05 and $6.66 is acting as a price equilibrium. Buyers are present, but they’re not strong enough yet to take out higher-timeframe supply.” He added that the recent wick above $7.00 represented “exhaustion rather than a confirmed breakout.”

BitXJournal market watcher emphasized that the broader picture remains constructive: “What matters is that ICP continues to hold above former trendline resistance. If that structure holds, momentum can rebuild over time.”

With ICP trading just under $6.00, the next key test is whether the market can maintain support at $6.05, which has acted as a mid-range floor across multiple daily sessions.

A sustained close above $6.66 would signal a breakout from the current consolidation and open the door toward higher supply levels near $7.50–$9.00.

For now, ICP appears balanced, with price compression suggesting a potential expansion—but direction will depend on whether bulls or bears gain control in this tightening range.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.