Technical outlook signals cautious optimism amid deeper liquidity retest

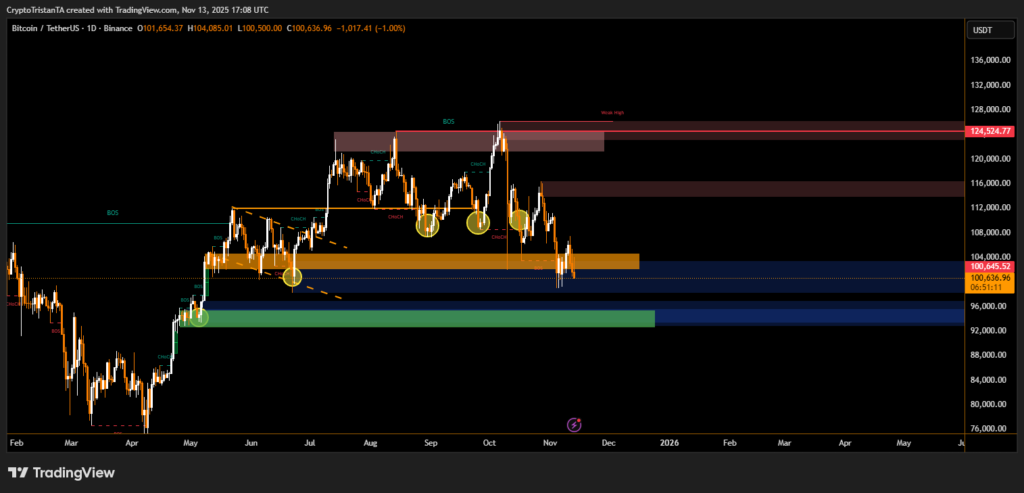

Bitcoin’s price has slipped below the $101,000 mark, testing a key psychological and structural support near $100K, as traders closely monitor the $95,000 demand zone for signs of a potential bullish rebound. The move comes after a month of volatile swings between major resistance zones and newly established liquidity pockets.

The latest technical structure highlights a break of short-term support following multiple Change of Character (ChoCH) signals on the daily chart, suggesting that momentum has temporarily shifted in favor of sellers. However, analysts argue that the broader market context remains constructive as long as Bitcoin holds above the deep blue accumulation area around $95,000, where previous bullish breakouts originated.

“This kind of retracement is typical before a continuation move. The $95K region is a crucial liquidity area — if it holds, it could provide the foundation for another leg higher,” said BitXJournal technical market strategist monitoring high-timeframe structures.

Historical order-block data shows that Bitcoin previously rebounded strongly from similar zones earlier this year, coinciding with Break of Structure (BOS) confirmations that triggered sustained rallies. The chart now reflects stacked demand levels below current price, implying that institutional participants may be waiting for a deeper fill before re-entering positions.

Meanwhile, resistance remains defined between $112,000 and $124,000, an area marked by weak highs and unmitigated supply clusters. Until these zones are reclaimed, market sentiment is likely to stay neutral-to-cautiously bullish, with short-term volatility expected as traders react to macroeconomic signals and ETF flow data.

In summary, while Bitcoin’s near-term technical picture shows weakness, the $95K support zone stands as a decisive battleground. A confirmed rebound from this level could validate a mid-term accumulation phase — setting the stage for a potential recovery toward the $110K–$120K range in the weeks ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.