Heavy institutional withdrawals reflect a sharp risk-off shift as Bitcoin drops to the mid-$96,000 range amid macro uncertainty.

Major Outflows Hit U.S. Bitcoin ETFs

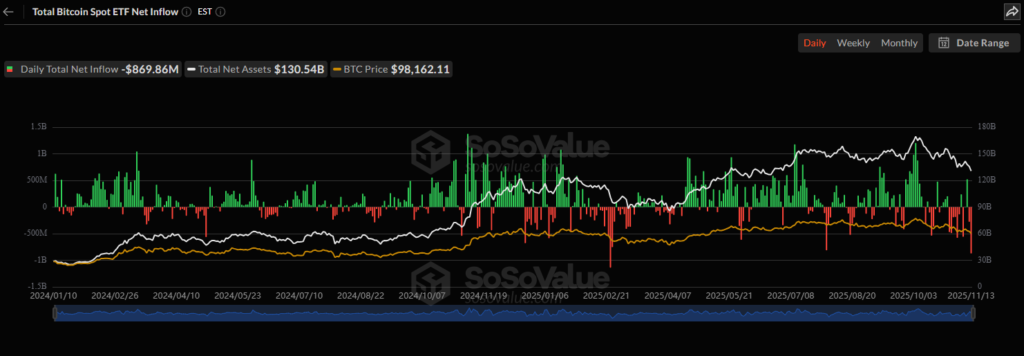

U.S. spot Bitcoin ETFs saw a significant wave of withdrawals on Thursday, totaling $869.9 million in net outflows — the second-largest daily exit since their launch. The steep reduction in ETF holdings coincided with a broader crypto market sell-off, pushing Bitcoin down 6.4% to $96,956.

ETF Outflows Reach Levels Not Seen Since February

Fresh data shows that multiple major ETF issuers faced substantial redemptions.

Grayscale’s Bitcoin Mini Trust led with $318.2 million withdrawn. BlackRock’s IBIT followed at $256.6 million, while Fidelity’s FBTC saw $119.9 million exit. Additional outflows were reported across funds from Ark and 21Shares, Bitwise, VanEck, Invesco, Valkyrie, and Franklin Templeton.

This marks the biggest exit day since Feb. 25, 2025, when outflows hit a record $1.14 billion.

Vincent Liu, CIO of Kronos Research, said the withdrawals reflect “a risk-off reset, with institutions pulling back amid macro noise.”

He added that while short-term momentum weakens, structural demand remains intact, creating potential openings for long-term investors.

Analysts Point to Broader Market De-Risking

The outflows align with a wider risk-off sentiment across global markets.

Min Jung, research associate at Presto Research, said the activity indicates “a broad de-risking across markets”, with investors rotating away from higher-beta assets.

Jung added that uncertainty around the Federal Reserve’s policy direction is contributing to anxiety, particularly as economic data signals a softening labor market.

“ADP and NFIB data point to a cooling labor market, reinforcing an ‘easing with caution’ stance from the Fed,” Jung noted.

Rate-cut expectations have shifted as well. According to CME’s FedWatch tool, the odds of a December rate cut have fallen to 52.1%.

Bitcoin Price Slips as Liquidity Thins

The ETF withdrawals coincided with intensified volatility in Bitcoin.

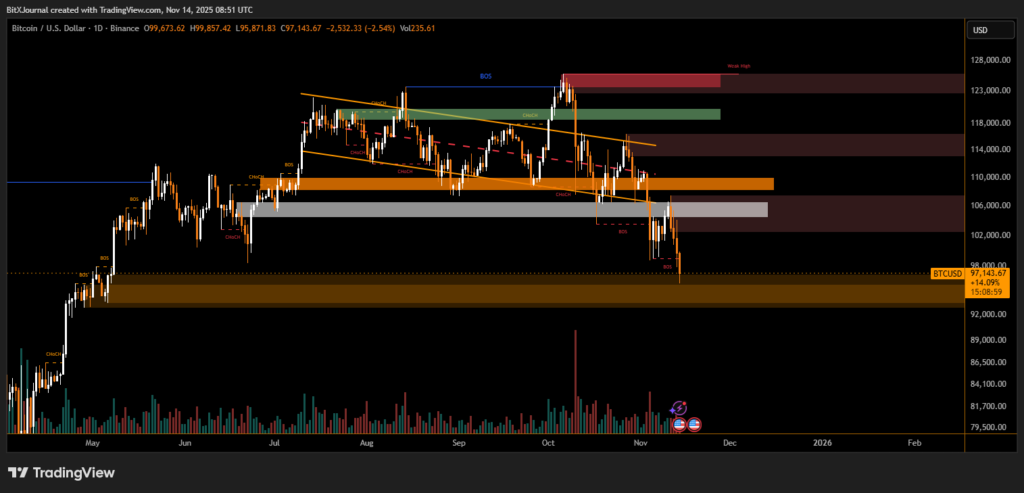

According to BitXJournal the decline was triggered by “a liquidity let-down, where cascading liquidations met a thinning bid stack.”

He noted that demand support appears clustered in the $92,000–$95,000 range, though market depth remains fragile until fresh spot flows return.

Justin d’Anethan, head of research at Arctic Digital, said Bitcoin is now sitting at a critical support zone.

“If we go lower, the next key level is the lower $90Ks,” he said.

He believes those zones could attract buyers who missed Bitcoin’s previous run above $120,000.

The sharp outflows from spot Bitcoin ETFs underscore heightened market caution as macroeconomic signals shift and liquidity thins. While analysts see potential for deeper pullbacks, many also view the current levels as a possible entry point for long-term investors amid persistent structural demand for Bitcoin.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.