XRP Slides Below Key $2.30 Level Despite Anticipation Around New ETF

XRP fell more than 7.3% in a volatile session, slipping below the $2.30 psychological support as broader crypto markets experienced renewed selling pressure. The decline came just days after the launch of a highly anticipated XRP-linked ETF, an event many traders expected would strengthen bullish momentum. Instead, the token met heavy distribution, erasing recent gains and reigniting concerns about short-term market structure.

A Break of Critical Market Structure

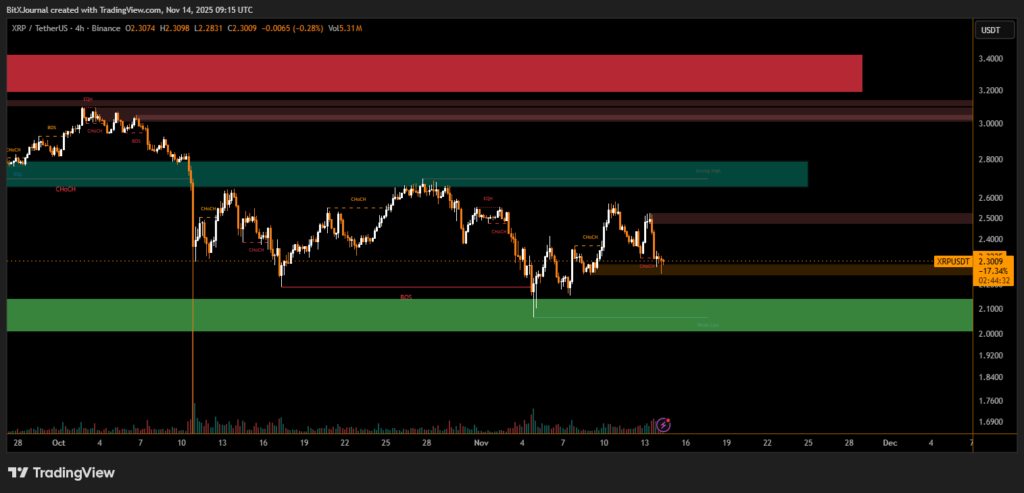

The 4-hour chart shows XRP losing its grip on a crucial mid-range level, with price tapping into a minor demand block before breaking lower. The drop also pushed XRP closer to the major $2.05–$2.15 demand zone, a region that previously sparked multiple recoveries.

BitXJournal Analysts note that XRP’s retreat was accelerated by synchronized selling across the market, triggered by a sharp downturn in Bitcoin. One market strategist observed, “The ETF debut created short-term optimism, but the market was already positioned for a correction. Once BTC began sliding, liquidity across altcoins drained quickly.”

Another technical researcher added, “The rejection from the $2.55 zone was clear distribution. Bulls simply didn’t have the volume to defend $2.30 once momentum shifted.”

ETF Hype Meets Reality

Despite strong early interest in the new product, the ETF launch did not generate sustained spot demand. Market watchers say that, while ETF listings often attract institutional curiosity, they do not necessarily produce immediate inflows.

BitXJournal derivatives analyst commented, “Traders overestimated the near-term impact. New listings take time to influence underlying price dynamics, especially during risk-off conditions.”

This sentiment aligns with recent trading behavior, as XRP showed multiple change-of-character signals on the chart before losing its higher-low structure.

Key Levels to Watch

XRP is currently sandwiched between a weakened local support zone and a strong higher-timeframe demand block. A decisive breakdown could expose $2.00, while reclaiming $2.30 remains the first step for bulls seeking recovery.

Further upside would require absorbing sell pressure near $2.50–$2.60, a region that has repeatedly capped rallies.

XRP now faces a crossroads. Its ability to hold above the underlined support region will determine whether the current move becomes a deeper correction or a reset before accumulation resumes. With volatility elevated and Bitcoin still dictating market direction, traders may expect continued choppiness in the sessions ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.