The meme-asset retreats toward a long-standing demand region after repeated rejections from upper resistance bands and weakening short-term momentum.

Dogecoin declined 4.8% in the latest session, slipping back into a critical support area that has historically acted as a stabilizing floor. The downturn comes amid broader market softness, with traders closely watching whether DOGE can maintain structure above the mid-$0.15 region. Chart signals show a decisive shift in momentum, as supply zones overhead continue to cap any meaningful rebound attempts.

Dogecoin Price Tests Key Technical Levels

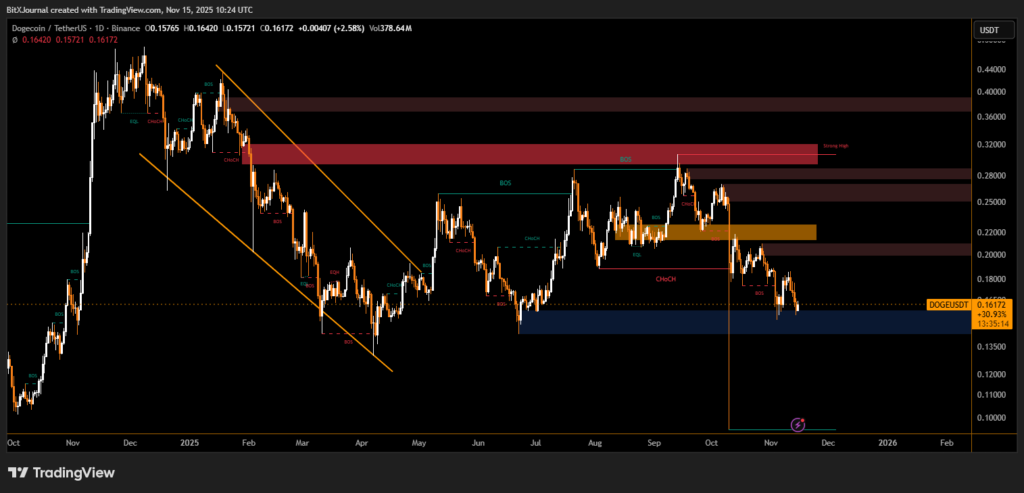

DOGE’s chart indicates a steady descent from the $0.22–$0.25 resistance block, where multiple attempts to break higher were met by persistent selling. After failing to maintain mid-range structure near $0.18, the token has returned to the $0.15–$0.16 demand zone, a level marked on the chart by earlier accumulation and strong reaction wicks.

BitXJournal independent market strategist noted, “Dogecoin continues to find sellers at every major resistance band. The recent drop is less about panic and more about the market reverting to deeper liquidity zones.”

A sequence of break-of-structure (BOS) and change-of-character (CHoCH) signals reveals weakening bullish control. The recent sweep below local lows suggests a deeper liquidity grab, increasing pressure on the current support. The market’s struggle to reclaim prior highs near $0.28, highlighted by the red supply region in the chart, underscores a shift from bullish optimism to defensive positioning.

BitXJournal technical analyst added, “The $0.15 area remains pivotal. Losing this level would expose DOGE to the broader liquidity void below, but holding it could spark a consolidation phase similar to what we saw in early summer.”

Meme-Asset Sentiment Shows Signs of Fatigue

Dogecoin’s decline mirrors a broader pullback across speculative altcoins. Trading volume remains elevated but skewed toward sell-side activity, indicating a cautious market environment. Although DOGE has historically staged strong rebounds from oversold zones, the repeated rejection from upper supply blocks suggests a more complex recovery path.

The immediate focus is whether the $0.15–$0.16 support zone holds, as maintaining this level may allow DOGE to stabilize before attempting another push toward $0.18. A breakdown below the current demand area, however, would open the door to deeper retracements, shaping sentiment for the weeks ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.