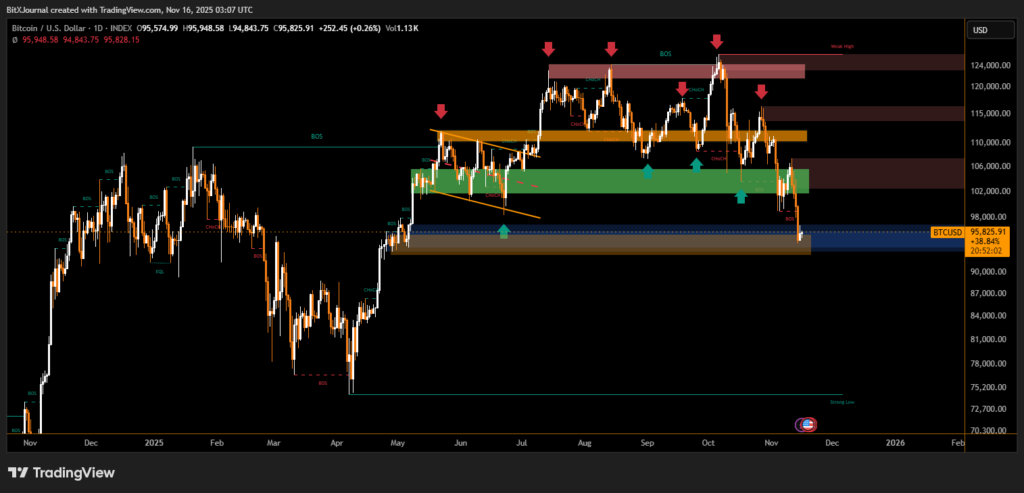

The leading cryptocurrency faces pressure after repeated rejections from upper resistance zones, pushing price back into a long-watched demand area.

Bitcoin is retreating toward a critical support zone after a series of failures to break through overhead supply levels. The recent movement, shown clearly in the latest technical chart, reflects a shift in market sentiment as buyers struggle to maintain control. The price hovering around the mid-$95,000 region highlights a decisive moment for the market’s near-term direction.

Bitcoin Technical Analysis Shows Structural Breakdown

The chart reveals that Bitcoin has been repeatedly rejected from the $118,000–$125,000 resistance band, where several strong supply zones capped upward momentum. Each rise into these areas triggered sharp sell-offs, marked by a sequence of CHoCH signals and lower highs.

After losing mid-range support near $106,000, Bitcoin dipped into the broad $98,000–$96,000 demand area, now acting as the final major structure before a potential deeper decline. The BOS markers, especially the most recent one printed after the breakdown from the green accumulation zone, underscore weakening bullish structure.

BitXJournal Analysts note that this shift is consistent with broader liquidity-seeking behavior. One market expert explained, “Every rally into resistance has been met with aggressive distribution. This tells us larger players are unloading positions at premium levels.”

BitXJournal analyst added, “The market is now testing the last strong support block. If buyers fail to defend this area, price could migrate toward the deeper liquidity pocket closer to the lower July structures.”

Key Levels Show Investor Caution

The chart highlights several underlined key zones that traders are watching closely. The upper red supply zones have consistently proven to be barriers, while the green accumulation region attempted to stabilize price multiple times but ultimately failed. Now, the blue and brown support range under Bitcoin must hold, or the market risks a continued downward move.

Market participants remain cautious, noting that Bitcoin’s current behavior reflects a market searching for balance. As BitXJournal strategist put it, “Until Bitcoin reclaims previous structure, rallies should be considered corrective rather than impulsive.”

Bitcoin’s next direction hinges on whether buyers defend the mid-$90,000 support. A firm bounce could reestablish short-term stability, but a breakdown may invite further selling pressure as the market seeks lower liquidity zones.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.