How asymmetric market behavior is shaping Bitcoin’s late-2025 outlook

Bitcoin Negative Skew Analysis

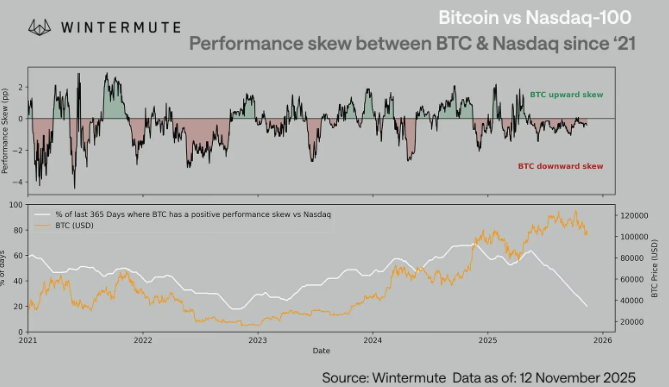

Bitcoin’s recent trading behavior has frustrated bullish traders, especially as the world’s largest cryptocurrency continues to react more sharply to downside equity moves while showing a muted response when stocks rally. This pattern—known as negative performance skew—has deepened in recent months and is now approaching levels last seen during the late-2022 market bottom. Analysts say this asymmetry may reveal weakening investor confidence, but it could also signal that a cyclical reset is nearing completion.

Market Asymmetry and Correlation Pressures

Despite Bitcoin maintaining a correlation of roughly 0.8 with the Nasdaq 100, the relationship has become increasingly one-sided. During Thursday’s sharp 2% decline in tech stocks, Bitcoin fell almost double that amount. Yet when equities staged a mild recovery on Friday, Bitcoin barely reacted.

Analyst Jasper De Maere noted that this is less about correlation fading and more about how Bitcoin reacts to risk. “This isn’t a breakdown in correlation but an uneven reaction to risk appetite,” he explained, highlighting the consistent pattern of BTC underperforming on risk-off days.

This dynamic has pushed Bitcoin’s positive-skew days on a 365-day basis to their lowest point since late 2022. According to market data, Bitcoin has risen less on good equity days and fallen more on bad ones, creating a widening pain gap for long-term holders.

Why Skew Has Turned Deeply Negative

Experts attribute the trend to several structural shifts:

- Liquidity has thinned, with ETF inflows slowing and stablecoin issuance flattening.

- Market depth remains below early-2024 levels, reducing Bitcoin’s ability to absorb volatility.

- Risk appetite favors equities, where both institutional and retail investors find more immediate momentum.

One market strategist said, “Bitcoin has temporarily lost mindshare as traders focus on equity opportunities. The crypto market is running on lighter liquidity, which exaggerates every move.”

Does This Signal a Bottom Forming?

Historical patterns suggest that deep negative skew rarely appears near market tops. Instead, it often emerges when investors are exhausted and selling pressure becomes more emotional than technical.

De Maere emphasized that “when Bitcoin falls harder on bad days than it rises on good ones, it typically indicates exhaustion, not renewed bearish strength.” This asymmetry, he argues, often coincides with bottom-building phases, where sentiment resets before a stronger recovery cycle.

With just weeks left in the year, Bitcoin is up only about 3% year-to-date, far behind the Nasdaq’s 20% gain. While the negative skew paints a challenging short-term picture, its historical context suggests that a market floor may not be far off.

For long-term investors, this phase of asymmetric volatility could represent the final stretch before a broader shift in momentum.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.