Whole week major cryptocurrencies slipped on macro pressures and ETF flows, the U.S. ended its longest shutdown, spot SOL and XRP ETFs advanced, and gold held above $4,100 / oz in a safe-haven surge.

In the week spanning Nov. 8 to Nov. 15, 2025, the crypto and precious-metals markets moved in tandem with major macro events. The U.S. federal government officially ended its record 43-day shutdown, triggering a release of pent-up economic data and renewed interest in regulatory and policy developments. Meanwhile, the crypto market saw slippage across marquee assets such as Bitcoin (BTC) and Ethereum (ETH) as risk sentiment turned cautious. On the ETF front, spot products based on Solana (SOL) and XRP surged ahead, signalling fresh institutional interest. At the same time, gold remained elevated above US $4,100 per ounce, buoyed by safe-haven demand and hopes for an impending interest-rate cut. This article unpacks each major theme with data, commentary and expert insight.

Crypto market dynamics:

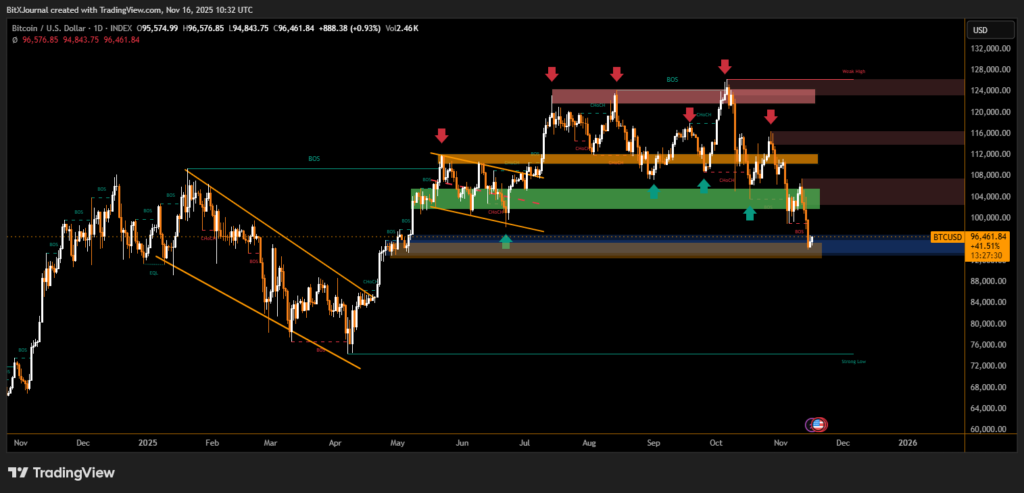

Bitcoin, after trading above the US $100,000 threshold, slipped to around US $95,000–96,000 in the aftermath of the shutdown’s conclusion. Market-sentiment gauges flagged “extreme fear”, with one index dropping to a reading of 10.

As BitXJournal analyst observed: “The sell-off is a confluence of profit-taking by long-term holders, institutional outflows, macro uncertainty, and leveraged longs getting wiped out.”

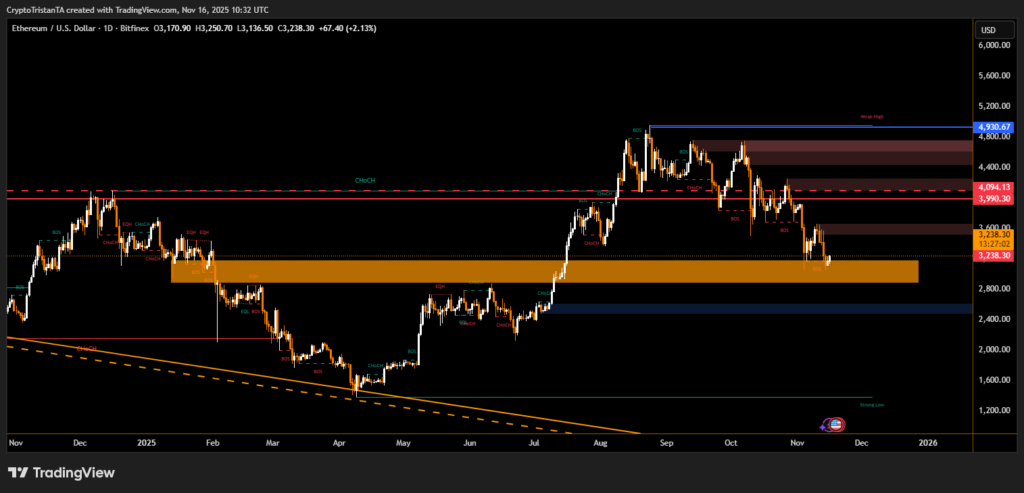

Meanwhile Ethereum also pulled back, hovering near the US $3,600 mark as investors reevaluated risk.

Broader data show crypto derivatives saw more than US $1 billion in liquidations in a single 24-hour window, long positions dominating the wipe-out.

ETF flows painted a similar image: US spot Bitcoin ETFs registered heavy outflows (≈ US $866 million in one day) despite policy tailwinds.

In short: the market is pausing. After the shutdown, institutional appetite is filtering through but uncertainty remains elevated.

U.S. government shutdown & regulatory update:

The federal government reopened on Nov. 12 after 43 days, the longest in U.S. history. That event carried significant implications for assets. With economic data delayed, the restart prompted speculation that the Federal Reserve might cut interest rates in December — a driver for non-yielding assets like crypto and gold.

From a regulatory standpoint, the U.S. Securities and Exchange Commission (SEC) issued guidance making clear that pending ETFs could become effective once certain administrative filings (Form 8-A) are completed, helping expedite crypto-ETF approvals.

Commenting on the reopening, BitXJournal industry source said: “The end of the shutdown marks more than just the reopening of Washington — it’s the resumption of one of crypto’s most pivotal years.”

Spot SOL & XRP ETF developments:

The first U.S. spot Solana ETF — launched by Bitwise Asset Management — debuted on Oct. 28 but featured in this week’s narrative as inflows continue and the market digests its implications. It reportedly gathered US $420 million in its first week.

According to tracking data, spot SOL ETFs noted their 11th + day of inflows, even as the underlying SOL price hit five-month lows.

On the XRP front, with regulatory overhang fading, ETF rollout is seen as imminent, boosting sentiment in XRP-linked products.

Analysts caution, however, that despite ETF interest, weak price action in SOL shows that “flows do not equal immediate breakout.”

In short: ETF infrastructure is advancing — but asset prices are not following yet.

Gold and safe-haven flows:

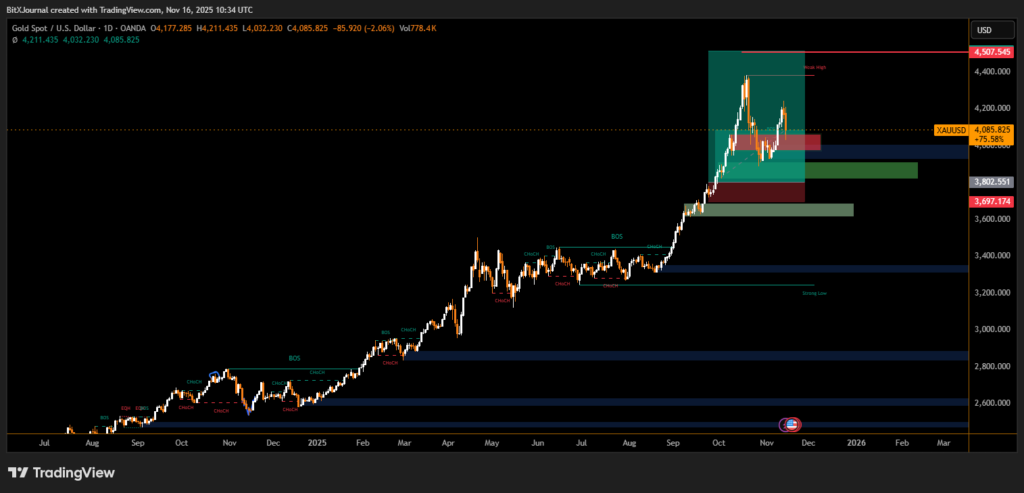

The precious-metals space saw robust movement. On Nov. 11, spot gold rose over 3 % to about US $4,129 per ounce — its highest in nearly three weeks — as the shutdown resolution increased hope for a Fed rate cut.

By Nov. 13 gold pulled back slightly to ~US $4,151 as the broader market sold off.

And early in the period (Nov. 8) gold closed at US $4,000.38 per ounce.

BitXJournal metal-markets trader remarked: “Precious metals are caught in a widespread sell-off, where stocks, bonds, the dollar and crypto are all under pressure and in the red.”

Overall: gold remains elevated as a hedge amid macro uncertainty, especially given the still-uncertain Fed path and reopened government data pipeline.

Between Nov. 8 and Nov. 15 the markets were shaped by a tug-of-war between risk appetite and caution. Crypto assets like Bitcoin and Ethereum pulled back as institutional flows reversed and liquidation pressure mounted. The end of the U.S. government shutdown reopened both economic data and regulatory activity — injecting fresh impetus into products such as spot SOL and XRP ETFs, but also reminding markets of macro-fragility. Meanwhile, gold held up strongly, riding safe-haven appeal and interest-rate narratives. For investors, the message is clear: infrastructure is aligning for crypto institutionalisation, but until sentiment turns, the market may remain range-bound. Simultaneously, traditional defensive assets continue to exert gravity. As one analyst put it: “Loose liquidity continues to support Bitcoin as an alternative to fiat and gold as a debasement hedge.”

Investors will now await further economic data releases, the Fed’s next move, and whether crypto flows can translate into renewed momentum.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.