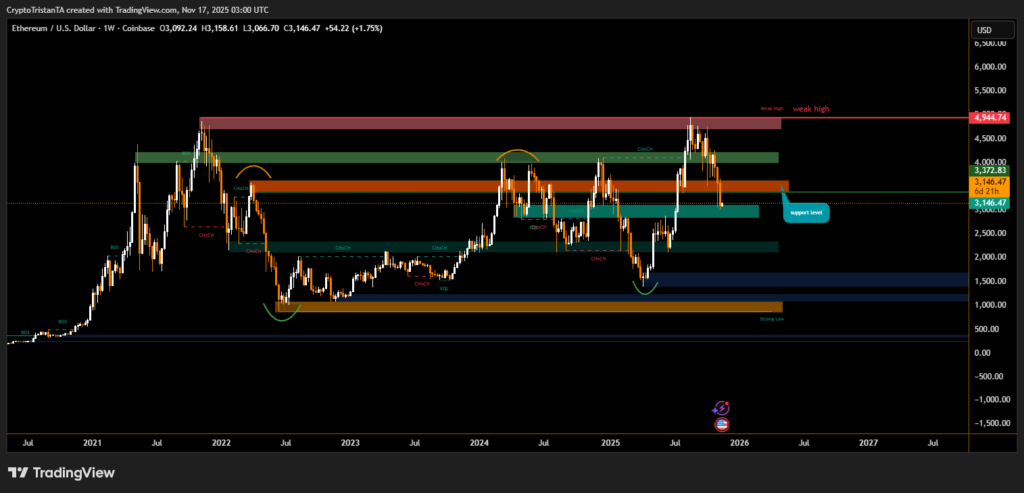

Ethereum steadied near $3,146, defending a critical weekly support zone after sliding from last month’s failed rally toward the $4,900 weak-high region. The latest chart signals a market entering a decisive phase, with bulls trying to maintain structure while sellers continue pressuring major resistance zones.

Ethereum Technical Market Outlook

The weekly chart you provided shows ETH losing momentum after tapping the $4,700–$4,900 supply block, an area marked repeatedly as a weak high due to its inability to generate sustained continuation. The rejection triggered a rotation back into the $3,700–$3,300 mid-range, where price has now paused at the lower boundary.

One of the key features on the chart is the recurring change of character (CHOCH) patterns around the same range that capped Ethereum’s advances in both 2022 and early 2024. Those earlier rejections formed a broader macro ceiling, now acting once again as heavy overhead pressure.

“What stands out is the symmetry — Ethereum continues to respect the same structural turning points,” BitXJournal analyst noted. “When you see recurring tops aligned with supply blocks, it highlights institutional positioning.”

Below the current level lies an even more important area: the $2,800–$2,600 demand block, which the chart labels as a former accumulation zone. This region supported the mid-2023 recovery and later served as a base for the 2024 rally. The reaction here may define Ethereum’s next major leg.

At the same time, multiple liquidity sweeps near $3,350, visible in earlier CHOCH clusters, suggest that the market remains highly reactive to short-term imbalances. BitXJournal market strategist added, “Until ETH closes back above the mid-range, bulls remain in a defensive stance. A sustained reclaim would shift sentiment quickly.”

Key Levels to Watch

The immediate focal point is the $3,146 support, which the chart explicitly identifies as a crucial pivot. A weekly close below this level opens the door to a sweep of the $2,600 zone, where long-term buyers historically stepped in. On the upside, reclaiming $3,700 would stabilize structure and offer the first signal of renewed bullish intent.

Ethereum’s weekly outlook remains balanced between risk and opportunity. While the $3,146 support holds for now, the broader trend depends on whether buyers can overcome the repeated resistance near $3,700–$4,000 and prevent another long-range correction.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.