Global crypto investment products face significant withdrawals amid uncertainty

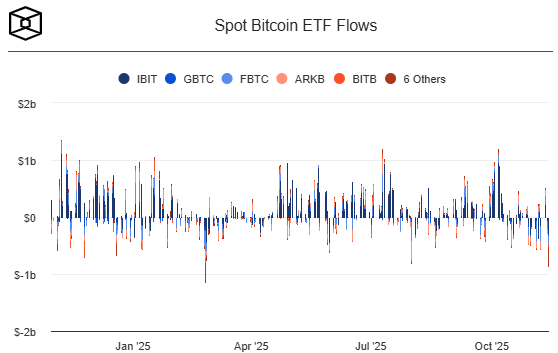

Crypto exchange-traded products (ETPs) have recorded their largest weekly outflows since February, with investors withdrawing approximately $2 billion in a sign of declining risk appetite across global markets. The trend highlights growing caution as uncertainty around monetary policy and market sentiment continues to weigh on the crypto sector.

According to recent data, crypto ETPs experienced three consecutive weeks of net outflows, totaling $3.2 billion over the period. Total assets under management (AUM) in these products fell to $191 billion, down 27% from October’s peak of $264 billion.

Monetary policy uncertainty and selling by crypto-native investors were cited as key drivers behind the withdrawals. James Butterfill, head of research at CoinShares, noted that “outflows were primarily driven by US investors reacting to broader market uncertainty and reallocating capital to safer assets.”

The United States accounted for the vast majority of outflows, with $1.97 billion withdrawn last week, while Germany was a rare exception, recording $13.2 million in inflows. Other regions including Switzerland, Sweden, Hong Kong, Canada, and Australia also saw modest outflows totaling $84.4 million combined.

The impact was most pronounced on single-asset crypto ETPs. Bitcoin-based products lost nearly $1.4 billion, equivalent to 2% of total AUM, while Ether-focused ETPs saw outflows of $700 million, or 4% of assets. Smaller crypto ETPs, such as those for Solana and XRP, experienced withdrawals of $8.3 million and $15.5 million, respectively.

In contrast, multi-asset crypto ETPs attracted $69 million in inflows over three weeks, reflecting a shift toward diversified exposure and reduced volatility. Additionally, short-Bitcoin funds saw $18.1 million in inflows, indicating a rise in hedging activity among cautious investors.

The latest data suggests that while investors are retreating from single-asset crypto products, there is still interest in diversified and hedged strategies as a way to navigate ongoing market uncertainty. The movement underscores a broader trend of capital rotation toward safer, more stable crypto investment vehicles amid fluctuating market conditions.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.