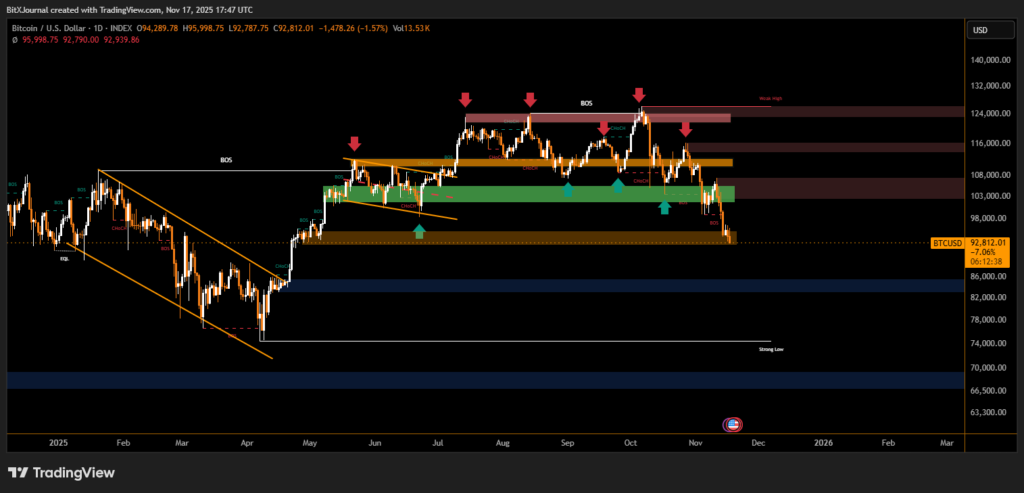

Market structure shifts bearish as $92K support becomes the final line protecting deeper downside

Bitcoin fell sharply to $92,840, marking its lowest level in six months, as technical signals on the daily chart point to weakening momentum and a shift in market structure. The decline places BTC directly inside a major demand zone that previously triggered multiple rallies earlier in the year.

The latest drop followed a clean break of several Break of Structure (BOS) and Change of Character (CHOCH) levels, showing a transition from bullish control into a corrective phase. “This type of multi-level structure breakdown usually implies that buyers are no longer defending aggressively,” said one market technician.

The chart also highlights a series of failed retests near $118K–$122K, forming what analysts describe as a cluster of weak highs—zones where sellers repeatedly rejected upward pressure. “Every rejection left behind liquidity that has not yet been reclaimed, which is a classic sign of a maturing top,” BitXJournal analyst noted.

Below current prices, the next major support sits around the $88K–$90K region, a deeper demand block that historically acted as a reversal area. The long-term structure still shows a strong low near $72K, but traders emphasize that this level only comes into play if the present zones fail.

“The important thing to watch is whether Bitcoin can maintain acceptance above the upper boundary of the demand block,” said BitXJournal analyst from a digital asset research . “A sustained close back above $97K would signal that sellers are losing strength.”

For now, the market remains cautious. The sequence of BOS and CHOCH events, along with liquidity sweeps across the mid-range, suggests that volatility may continue until buyers regain clear control.

The critical focus is whether Bitcoin can stabilize above the current zone. A breakdown from $92K could open the path toward much lower liquidity levels.

At the same time, a sharp rebound from this area has historically triggered multi-week bullish impulses, making the next few sessions crucial.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.