Industry executives point to signs of seller exhaustion and call current price levels a “generational opportunity” for long-term Bitcoin investors.

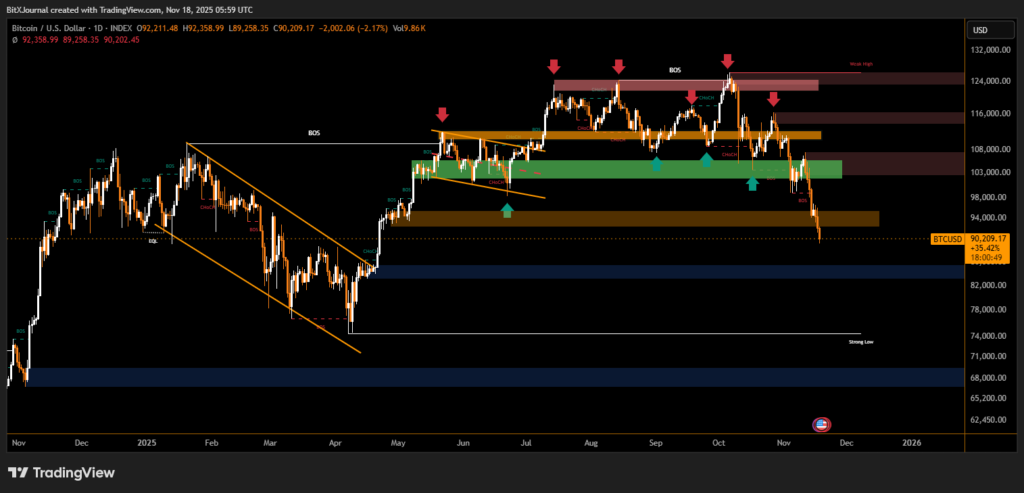

Bitcoin’s slide under the $90,000 mark has ignited renewed debate over whether a market bottom is approaching. As volatility intensifies and traders react to macroeconomic uncertainty, several high-profile industry executives believe the current downturn could be nearing its end. Their comments highlight growing confidence that Bitcoin may soon stabilize — and potentially set the stage for a strong rebound.

Experts Suggest a Bottom Is Near

Bitcoin briefly dipped below $90,000, its lowest price in seven months, sparking anxiety across the market. Yet according to BitMine chairman Tom Lee, the recent decline shows signs of exhaustion following October’s major liquidation event.

Lee explained that concerns around potential U.S. Federal Reserve rate decisions are still weighing on investors, but added that market indicators now resemble conditions typically seen near price bottoms.

“There are signs that would look like a bottom that could be occurring sometime this week,” Lee said in a recent interview.

Matt Hougan, chief investment officer at Bitwise Asset Management, echoed this expectation, calling the current correction a major opportunity for committed investors.

Hougan emphasized that broader economic worries — including AI sector valuations and tariff-related uncertainty — have contributed to market weakness. However, he believes Bitcoin’s leading role in this downturn also positions it to be the first asset to recover.

“I think we’re nearing a bottom… I look at this as a great buying opportunity for long-term investors,” Hougan noted.

“Bitcoin was the first thing to turn over… and I think it’ll be the first thing to bottom.”

Long-Term Investors Eye a “Generational Opportunity”

Despite dropping roughly 28% from its all-time high of more than $126,000 set in early October, analysts maintain that Bitcoin’s structural fundamentals remain intact. Hougan described the pullback as a “gift for long-term investors,” reinforcing the belief that temporary volatility may provide strategic entry points.

Market observers note that ongoing ETF outflows, whale profit-taking, and geopolitical tensions have contributed to recent weakness. Yet several indicators now point toward a reduction in selling pressure and a potential stabilization ahead.

BitMine’s Lee Sees New Highs by Year-End

Looking forward, Lee remains optimistic. He predicts that strength in the stock market later this year could help push Bitcoin to a new all-time high, fully recovering its recent losses.

“As markets rally, I think that’s going to help propel Bitcoin to an all-time high,” he said.

With sentiment at a critical juncture and analysts forecasting a bottom soon, attention is now focused on whether Bitcoin can reclaim momentum — or if more volatility lies ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.