BTC.D Chart Shows Decline Into Support Zones While Broader Market Avoids Risk Rotation

Bitcoin’s dominance has slipped below 59%, aligning with the asset’s own price pullback. While some traders typically view a decline in BTC dominance as a precursor to altcoin strength, current technical and structural signals suggest the market is not yet preparing for a full-scale rotation. Instead, analysts say the drop reflects a period of leverage reduction rather than a shift toward high-beta risk.

Dominance Retreats From Overhead Supply

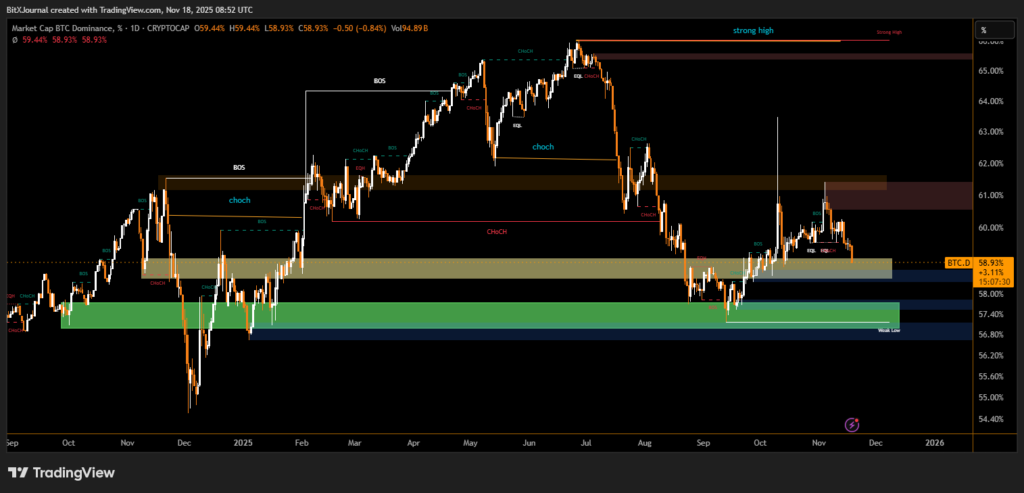

The BTC.D chart shows that dominance recently tapped a major supply band near 62%–63%, triggering a pattern of rejection identical to earlier rejections in late summer. The move aligns with multiple Breaks of Structure (BOS) and Change of Character (ChoCH) events on the upper time frame, signaling a loss of upward momentum.

This upper region has acted as a decisive ceiling for months, reinforcing the idea that Bitcoin’s dominance struggled to maintain control at elevated levels.

BitXJournal market analyst says, “The rejection from the high-confluence supply zone was expected. Dominance had been grinding upward without strong participation from altcoins, which made it fragile.”

Decline Tracks Into Key Demand Layer

Below current levels, a large demand zone between 57.4% and 58.2% remains the nearest structural support. This area has historically served as a stabilizing midpoint during several market cycles.

A clean break beneath this demand region would indicate a deeper restructuring and could open the door to additional dominance weakness.

BitXJournal observers notes, “This is a high-signal demand band. If dominance loses this level decisively, it could hint at upcoming changes in capital positioning—but we are not there yet.”

Altcoin Season Indicators Still Neutral

Despite Bitcoin’s decline, altcoins have not shown the synchronized expansion typically associated with seasonal rotations. Cross-pair charts remain flat, and major sectors outside Bitcoin have not produced significant trend breakouts.

Outlook

While Bitcoin dominance is bleeding lower alongside price, the market’s behavior still resembles a leverage reset, not an early altcoin surge. Until dominance breaks decisively below structural support and altcoins display sustained strength, analysts say a true rotation remains out of reach.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.