Major crypto-linked equities tumble as market pressure intensifies ahead of key earnings

ARK Invest has expanded its exposure to crypto exchange Bullish, acquiring over $10 million worth of shares during a steep sell-off across the digital-asset sector. The investment came as Bullish’s stock dropped to a new all-time low, reflecting a broader downturn that hammered major mining firms, exchanges, and blockchain-linked companies.

ARK Invest Buys the Dip in Bullish

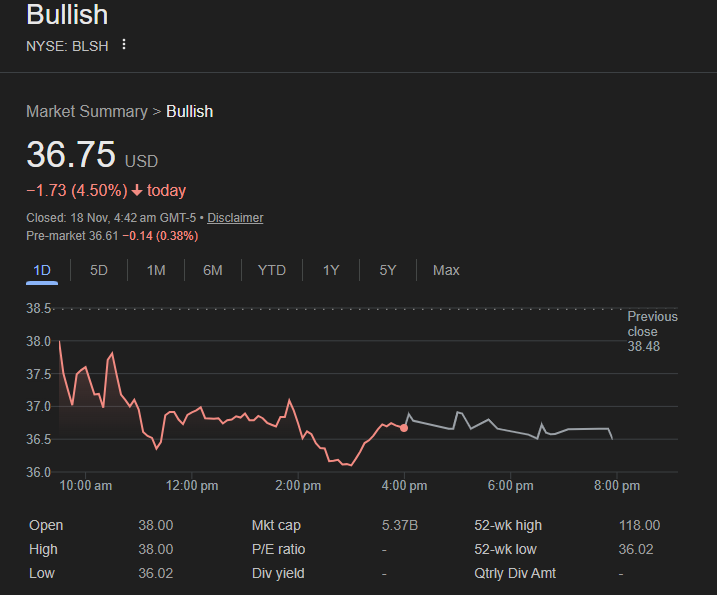

According to its latest trade disclosures, ARK Invest’s major innovation-focused funds added a combined 277,000+ Bullish shares during Monday’s session. The purchase followed a 4.5% drop in Bullish’s stock to $36.75, extending a multi-month decline that has erased nearly 46% of its value in six months.

The timing of the buy is notable given that the exchange is set to release its third-quarter earnings on Wednesday. Previous results showed adjusted revenue of $57 million in Q2, a decrease from the prior year, though the platform reported a sharp turnaround to more than $108 million in net income.

Market strategist Carla Jimenez said the move signals conviction from institutional investors:

“Accumulating during steep drawdowns suggests ARK sees long-term strength in Bullish’s core metrics, even as sentiment remains fragile.”

Crypto Stocks Slide Across the Board

Monday’s rout hit nearly every corner of the crypto-equity landscape. Mining firms faced some of the heaviest pressure, with Marathon Digital, Riot Platforms, and CleanSpark all ending the session in negative territory. Treasury-focused company Strategy fell another 2%, deepening a week-long decline of more than 18%.

Stablecoin issuer Circle, which recently entered public markets, declined more than 6% and is now down over 26% in five trading sessions.

Largest U.S. exchange Coinbase saw its shares close down 7%, reflecting broad selling across risk assets.

Economic analyst Brian Keller noted, “The pullback highlights how closely crypto equities track liquidity cycles, and right now investors are reducing exposure across the board.”

Analysts Say Bitcoin May Be Nearing a Bottom

Even as equities slump, some market leaders believe bitcoin may be approaching a key turning point. Industry executives argue that the price pressure stems from ETF outflows, whale selling, geopolitical stress, AI-sector valuation concerns, and uncertainty around U.S. economic policy.

BitMine chairman Tom Lee pointed to signs of “sell-off exhaustion,” while Bitwise’s Matt Hougan called the current range a ‘generational opportunity’ for long-term investors.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.