New system aims to make self-custody crypto payments safer and as intuitive as traditional finance

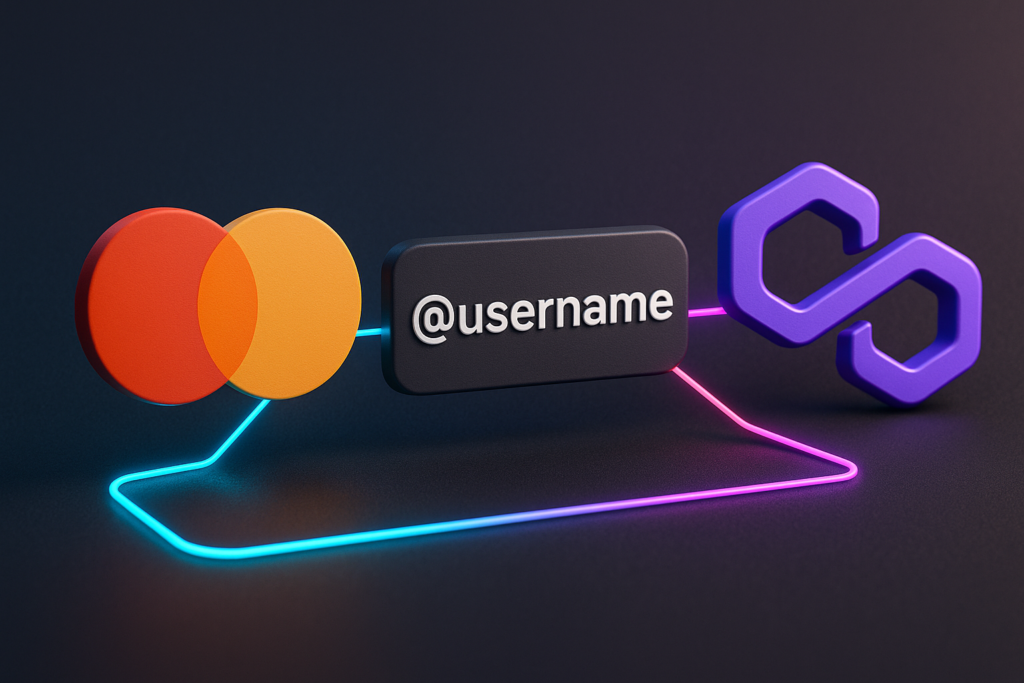

Mastercard is advancing its push into digital assets by introducing verified, human-readable aliases for self-custody wallets—removing the need for users to handle long, complex crypto addresses. The upgrade is launching with Polygon as the first supported blockchain, while Mercuryo will oversee verification and issue the user-friendly aliases.

Mastercard Brings Usernames to Self-Custody Wallets

Through the expanded Crypto Credential program, individuals will be able to send and receive cryptocurrency using simple, recognizable usernames instead of the typical hexadecimal strings. Once identity verification is completed by Mercuryo, users can bind an alias to their wallet or generate a soulbound token on Polygon that confirms the wallet belongs to a verified person.

A Mastercard executive described the change as a meaningful step toward safer digital transactions:

“Streamlining wallet identifiers and adding verification layers helps build trust and reduces mistakes during token transfers.”

Polygon Labs highlighted the simplicity the system brings, emphasizing that the partnership removes friction for everyday users.

“This is the point where self-custody becomes truly accessible,” said a company representative, noting that reducing address-related errors has become a top priority for the ecosystem.

Enhancing Safety Without Sacrificing Control

The update is designed to mimic the familiar experience of traditional payment rails, while still preserving wallet sovereignty. Mercuryo, serving as the first issuer for the program, says demand for secure yet user-controlled crypto experiences has grown quickly, especially among users entering Web3 for the first time.

Mastercard has been steadily expanding its crypto footprint through 2024 and 2025, introducing partnerships such as:

- A self-custody payments card built with MetaMask

- Crypto-enabled debit cards launched with Kraken across Europe

- Onchain purchase capabilities supported by multiple Web3 providers

Chainlink Integration Bolsters Mastercard’s Web3 Push

Earlier this year, Mastercard also teamed up with Chainlink to enable onchain crypto purchases for its global cardholder network. The system works with partners including Shift4, Swapper Finance, XSwap, and ZeroHash, with ZeroHash managing onchain liquidity for fiat-to-crypto swaps. Chainlink emphasized that the Swapper version is non-custodial, using account abstraction to provide a seamless experience for mainstream users.

By combining verified identities, human-readable aliases, and multi-chain support, Mastercard aims to eliminate one of the biggest frictions in crypto: the fear of sending funds to the wrong address. The program positions self-custody as safer and more practical, while deepening Mastercard’s presence in the evolving Web3 payments landscape.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.