Blockchain analytics firm Bubblemaps identifies 14,000 interconnected wallets in aPriori token claim, raising questions about airdrop integrity and transparency.

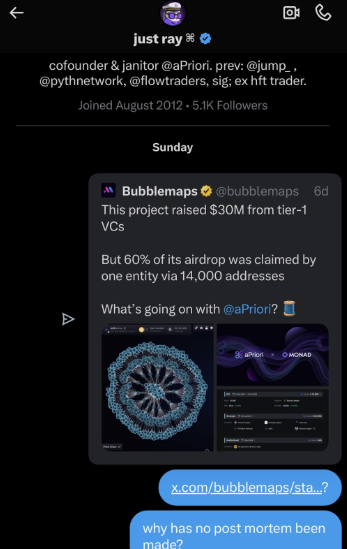

The crypto community is scrutinizing the recent token airdrop from Pantera-backed startup aPriori after on-chain data revealed a deeply concentrated distribution. According to a report from blockchain analytics platform Bubblemaps, a single entity successfully claimed approximately 60% of the airdrop allocations using a network of thousands of wallets, sparking allegations of unfair practices and a lack of project transparency.

The analysis indicates that the entity operated 14,000 interconnected wallets, all of which were freshly funded with small, identical amounts of BNB from the Binance exchange just before the airdrop claim went live. Following the event, all wallets subsequently forwarded their allocated APR tokens to new addresses. This coordinated activity suggests a sophisticated operation designed to maximize airdrop rewards, a practice often attributed to professional airdrop farmers.

About 12% of the total APR token supply was allocated to this airdrop, which launched on October 23. The token quickly surpassed a $300 million market capitalization. The San Francisco-based firm, founded by former quant traders from prominent firms, had recently secured $20 million in a funding round led by Pantera Capital.

Despite the severity of the claims, aPriori has remained largely silent. Since the airdrop, the project’s official social media channel has posted only once on an unrelated topic. This silence has drawn criticism from industry watchdogs. On-chain investigator ZachXBT commented on the situation, stating, “Still no reply from the co-founder, the way they have given zero transparency makes them look no different from scammers.”

While the data points to potential airdrop farming, the extreme concentration has led to broader concerns. Experts note that such events undermine the core purpose of airdrops, which are typically intended to decentralize token ownership and reward a wide base of genuine users. The incident highlights the ongoing challenge projects face in designing Sybil-resistant distribution mechanisms and maintaining open communication with their communities during crises. The crypto market now watches to see if aPriori will break its silence and address the mounting questions.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.