Solana Shows Resilience While Market Faces Heavy Selling Pressure

Solana posted a 6% intraday gain despite a broadly negative trading session across the digital asset market. While most major tokens continue to struggle, SOL moved higher from a key demand region on the daily chart, signaling renewed interest from buyers at technically significant levels. The move comes as the asset attempts to stabilize following weeks of structural declines and repeated rejections from overhead supply zones.

Solana Rebounds From Critical Support Zone

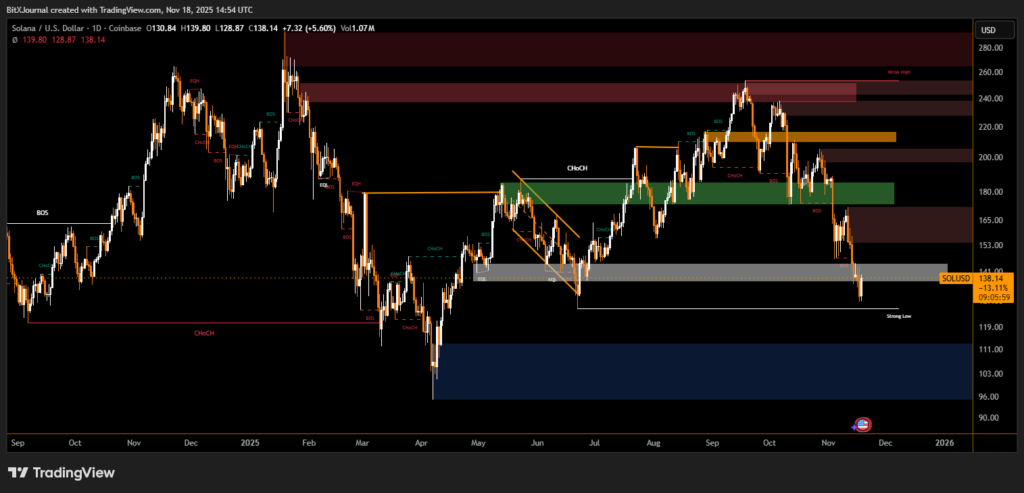

The daily chart reveals SOL holding above a crucial gray support band near $135–$140, an area that has repeatedly served as a reaction point in earlier market cycles. Recent price action shows a clear Break of Structure (BOS) followed by a retest of a strong low, a pattern often associated with liquidity exhaustion before recovery phases.

BitXJournal market analyst reviewing the current setup noted the importance of the zone where SOL bounced:

“The reaction off the mid-range support indicates that buyers are still defending key territory. The 6% move is a sign that demand remains active even in a pressured market.”

BitXJournal technical observer pointed to the broader structural implications:

“Solana has been trading within a descending corrective pattern. A strong rebound from this area could be the first signal of a shift in momentum, provided the asset can reclaim the next supply block above $150.”

Supply Barriers Remain Key for Trend Confirmation

Overhead supply zones between $165–$180 and the extended region near $200–$220 continue to cap upward movement. These levels, highlighted in the chart’s red and amber zones, represent areas where sellers dominated earlier attempts at recovery.

BitXJournal Technicians emphasize that reclaiming a premium zone is essential to neutralizing the broader downtrend. Until then, Solana remains vulnerable to market-wide volatility even with short-term strength.

Solana’s 6% gain marks one of the stronger performances among large-cap assets during a period of market uncertainty. While the bounce provides near-term optimism, the asset must overcome its layered supply zones to confirm a sustained recovery. For now, traders are watching whether Solana can maintain momentum above the $138–$145 range, or if the rally will face pressure as the market navigates ongoing macro and liquidity challenges.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.