Matt Hougan argues that long-term demand for Bitcoin’s wealth-storage utility outweighs short-term price volatility.

Bitwise Chief Investment Officer Matt Hougan is pushing back against growing concerns of a prolonged Bitcoin downturn, saying the asset’s resilience comes from a deeper, structural source: its role as a digital wealth-storage service. In a memo circulated to clients, Hougan said recent volatility does not alter Bitcoin’s long-term trajectory, especially as institutional demand continues to accelerate.

Bitcoin’s Pullback Seen as Temporary

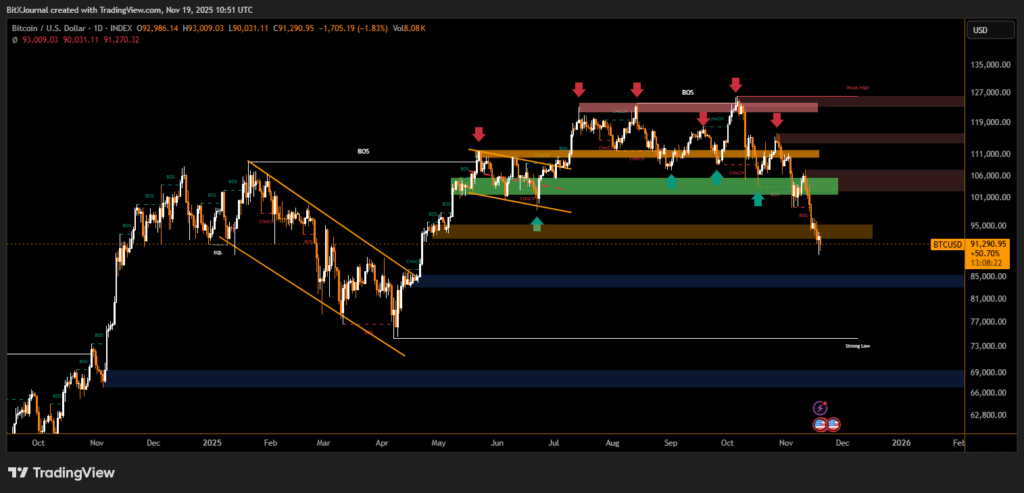

Bitcoin is down roughly 27.5% from its October peak of nearly $126,000, briefly dropping under the $90,000 threshold earlier this week. Despite the correction, Hougan emphasized that the decline reflects normal market behavior, not a fundamental breakdown.

A market strategist familiar with institutional flows said “the fear narrative is louder than the actual data, and long-horizon buyers are still accumulating.”

Hougan told clients he is “not at all concerned” about the recent retracement and sees it as part of the asset’s recurring cycle of sharp advances followed by cooling periods.

Bitcoin as a Digital Service, Not an Object

Hougan focused on a central question many financial advisors still struggle with: why does Bitcoin have value at all?

He noted that Bitcoin doesn’t produce cash flow, profits, or dividends, leading some to dismiss it as a purely speculative object. But Hougan argues that such thinking misses the point.

“Bitcoin’s value comes from the service it provides — the ability to store wealth digitally without relying on a government, a bank or any third party,” he wrote.

He compared this to how investors value major tech companies:

“The value of Microsoft’s stock is tied to how many people want its service. Bitcoin works the same way. The more people who want its service, the more valuable it becomes.”

Unlike traditional tech services, however, access to Bitcoin’s utility requires owning the asset directly — there is no subscription or rental model.

Institutional Interest Strengthens the Case

Hougan pointed to Bitcoin’s 28,000% gain over the past decade as evidence of rising demand for its unique “service.” Today, interest spans hedge funds, university endowments, sovereign wealth funds, pension systems, and prominent investors including Ray Dalio and Stan Druckenmiller.

An institutional analyst noted that “large allocators view Bitcoin less as a trade and more as insurance against debt expansion and financial uncertainty.”

Despite the recent pullback, Hougan argues that Bitcoin’s long-term thesis remains solid. Its value, he says, is tied not to short-term price swings but to the expanding demand for its third-party-free digital wealth-storage service — a utility more institutions are embracing as global financial conditions shift.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.