Experts point to excessive futures leverage and shifting liquidity cycles as the real drivers behind Bitcoin’s latest correction.

Why Bitcoin Really Fell From Recent Highs

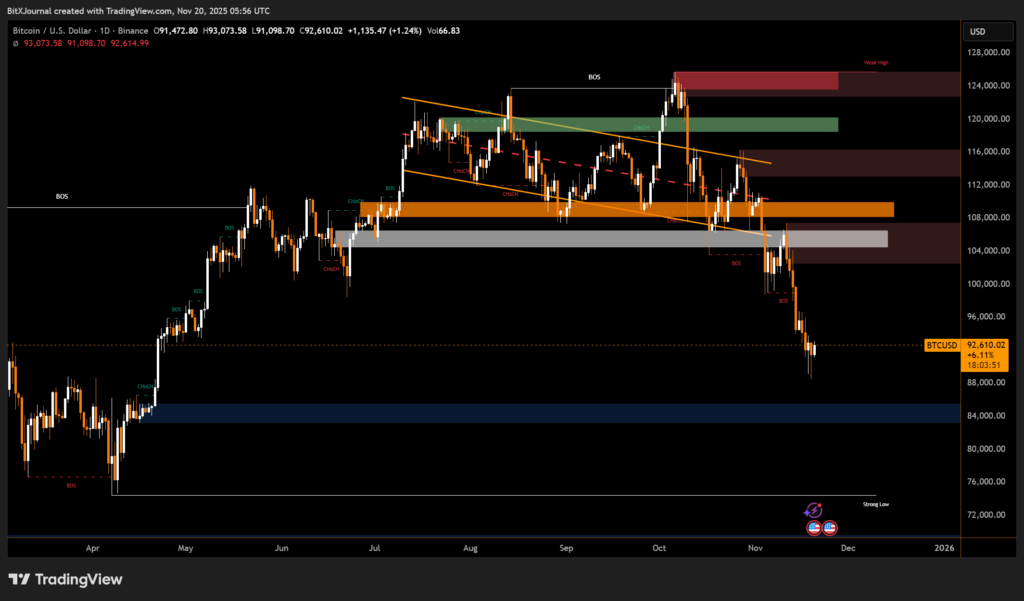

Bitcoin’s sharp decline from its $125,000 peak in October has sparked debate across the market. Many linked the drop to the US government shutdown, while others pointed toward fears of an AI-fueled tech bubble. However, leading analysts say these claims overlook the true causes behind the downturn. Their insights suggest the correction may actually strengthen Bitcoin’s long-term structure.

Excessive Futures Leverage Behind Bitcoin’s Pullback

Onchain analyst Rational Root challenged mainstream explanations, stating that Bitcoin’s market behaviour is driven more by internal leverage dynamics than external news events.

“I wouldn’t contribute the drawdown in Bitcoin all to the shutdown of the government,” he said.

Instead, he attributed the decline to “too high levels of futures leverage in Bitcoin.”

Periods of intense futures activity often magnify corrections, creating forced liquidations that push prices down further. According to the analyst, this reset has flushed out speculative excess and created a cleaner foundation for recovery.

AI Bubble Fears Not a Factor

Despite claims that anxiety over an AI bubble is spilling into crypto, several analysts disagree.

Market observer PlanC dismissed this notion, especially after strong AI-sector performance:

“We can remove the AI bubble thesis from the list of reasons Bitcoin is down,” he said, noting Nvidia’s record-setting quarterly revenue.

As these theories fade, analysts say the field of valid explanations is narrowing.

Cycle Models and Liquidity Remain Key Variables

PlanC emphasized the limited remaining factors:

“Only the 4-year cycle astrology narrative and delayed global liquidity remain.”

Some industry leaders believe the familiar halving-driven cycles may be losing their influence, especially as institutional participation grows. Meanwhile, global liquidity continues to play a dominant role. One executive recently stated that “Bitcoin is the most sensitive to liquidity. It moves first.”

This highlights how shifts in the global money supply can shape Bitcoin’s broader trajectory.

A Healthy Reset Before the Next Bull Phase?

Rational Root noted that the market has now experienced multiple deep resets within the last three years — each followed by renewed upward movement:

“Every one of these resets has allowed us to move higher.”

He expects the next phase of growth to be more gradual and structurally sound, supported by healthier market conditions.

With leverage cleared and speculative narratives fading, Bitcoin may be preparing for a more stable path forward driven by liquidity trends and long-term market evolution.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.