Fed policy uncertainty deepens while crypto markets enter “extreme fear” territory

The probability of a Federal Reserve rate cut in December has fallen sharply to 33%, mirroring the steep deterioration in global risk sentiment as Bitcoin sinks below $89,000. The shift marks a dramatic reversal from early November, when traders were pricing in a 67% chance of a cut.

Markets rethink the Fed path

Fresh data from major derivatives and prediction markets shows investors rapidly pulling back expectations for near-term easing. The decline comes as inflation concerns persist and crypto assets extend their multi-week slide.

Analysts say the sudden drop reflects a market that is growing uneasy about both macro conditions and digital-asset valuations.

“The market has stopped assuming the Fed will rescue risk assets in December,” said one macro strategist at a New York investment firm.

Rate cut expectations fall across markets

Probabilities tracked by the Chicago Mercantile Exchange now show just 33% odds of a December cut — down from nearly 70% at the start of the month. Prediction markets Kalshi and Polymarket place expectations slightly higher, around 67%–70%, but those figures also represent cooling optimism.

“The shift tells you traders are recalibrating for stickier inflation and tighter financial conditions,” noted an analyst from The Kobeissi Letter.

“When rate-cut confidence disappears, speculative assets tend to react first.”

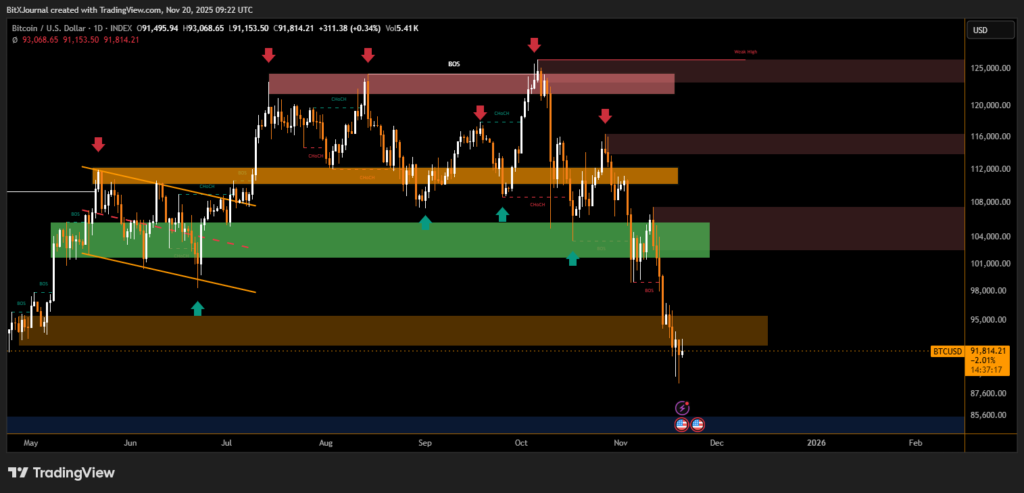

Bitcoin breaks key support as fear rises

Bitcoin’s slide below $89,000 has intensified concern across the digital-asset market. The cryptocurrency has now traded six consecutive days beneath its 365-day moving average, a level many long-term traders consider essential support.

Adding to the pressure, Bitcoin’s 50-day EMA has crossed below the 200-day EMA — a classic death-cross formation that often signals further downside.

“If BTC doesn’t rebound within the next week, the market should prepare for another leg down,” said market analyst Benjamin Cowen.

Some projections point to a potential retest of $75,000, a level viewed as a possible cyclical bottom heading into late 2025.

Sentiment hits ‘extreme fear’

The Crypto Fear & Greed Index now sits at 16, just above its lowest reading of the year.

This reflects a market environment where caution dominates and liquidity thins rapidly during sell-offs.

“Extreme fear does not guarantee a bottom, but it tells you investors are bracing for volatility,” added another analyst.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.