U.S. bitcoin ETFs return to positive flows following a five-day outflow streak, while altcoin ETFs show mixed performance.

U.S. spot Bitcoin ETFs returned to net inflows on Wednesday, breaking a five-day streak of outflows that had seen $2.26 billion exit the funds. The recovery in flows coincided with a modest rebound in bitcoin prices, which climbed above $92,000, signaling renewed investor interest after a period of market uncertainty.

Bitcoin ETF Flows Rebound

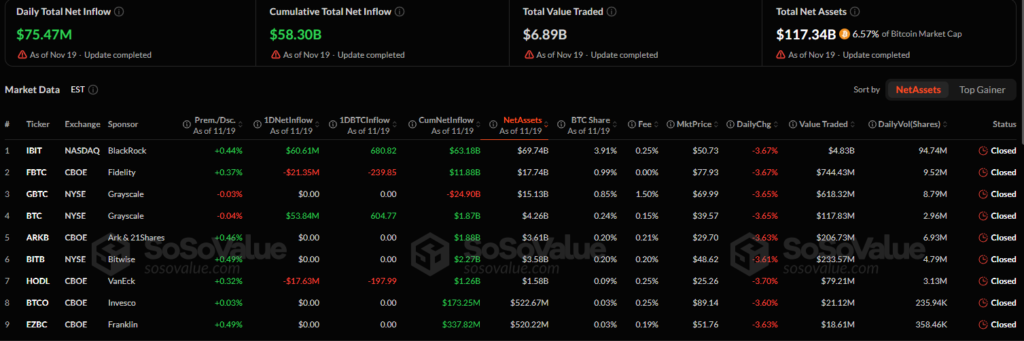

Data from SoSoValue shows that the total net inflows across bitcoin ETFs reached $75.47 million, with BlackRock’s IBIT fund attracting $60.61 million, following a record $523 million outflow the previous day. Grayscale’s Mini Bitcoin Trust also received $53.84 million in net inflows.

However, not all funds benefited from the rebound. Fidelity’s FBTC experienced $21.35 million in outflows, while VanEck’s HODL saw $17.63 million exit the fund.

Vincent Liu, CIO at Kronos Research, commented on the pattern, stating that ETF outflows represented “institutional recalibration rather than market capitulation”, adding that risk-on appetite is likely to return once macroeconomic signals clarify.

Macro Factors and Market Context

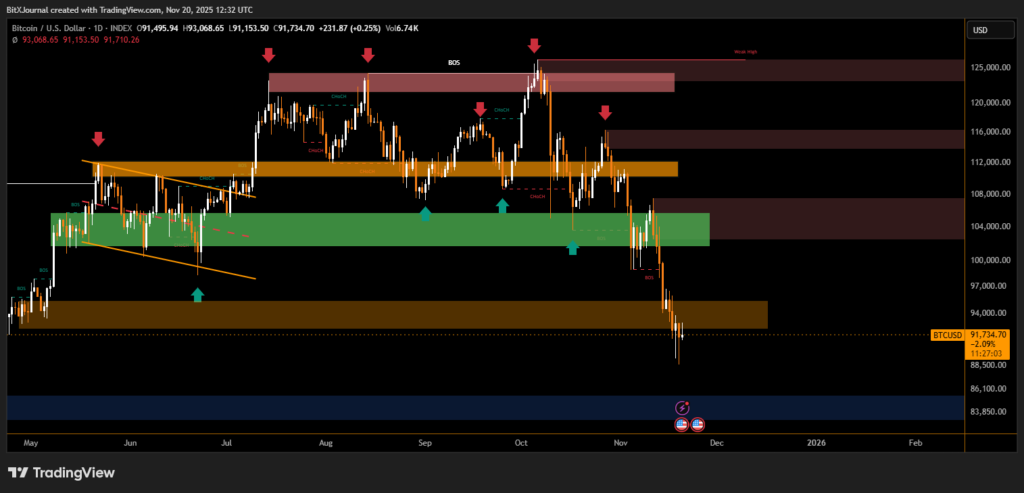

The broader crypto market has faced pressure amid macroeconomic uncertainty. The Federal Reserve’s upcoming December interest rate decision has influenced investor sentiment, with CME Group’s FedWatch Tool showing a 33.8% chance of a 25-basis-point rate cut, down from 48.9% earlier this week. Extreme market caution is reflected in the Crypto Fear and Greed Index, currently at 11, indicating extreme fear.

Analysts have also noted that reduced market liquidity due to the 43-day U.S. government shutdown contributed to recent price volatility. Bitcoin recently dipped below $90,000 before its slight recovery, marking a 0.72% gain over the past 24 hours, trading around $92,200.

Altcoin ETF Performance

While Ethereum ETFs continued a seven-day outflow streak, shedding $37.35 million, some altcoin ETFs performed strongly. Spot Solana ETFs recorded $55.6 million in net inflows, and newly launched funds have brought the total number of U.S. spot Solana ETFs to six.

Canary Capital’s XRP ETF attracted $15.8 million, and its Hedera (HBAR) fund saw $577,180 in inflows. Meanwhile, Canary’s Litecoin ETF reported zero flows for the day, highlighting the uneven performance across altcoin-focused products.

The rebound in spot Bitcoin ETFs and the gradual recovery in BTC prices suggest that investors are returning to digital assets after a period of caution. However, ongoing macro uncertainty and varied performance in altcoin ETFs indicate that the market remains sensitive to liquidity and institutional activity, with flows likely to fluctuate as economic signals and policy decisions evolve.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.