Analysts warn that October’s liquidation shock continues to pressure digital asset liquidity

The cryptocurrency market’s recent decline may be tied to a deeper liquidity disruption among major market makers, according to new industry assessments. Following the sharp Oct. 10 sell-off — when more than $20 billion in leveraged positions were liquidated — concerns are rising that the structural damage has not yet fully surfaced.

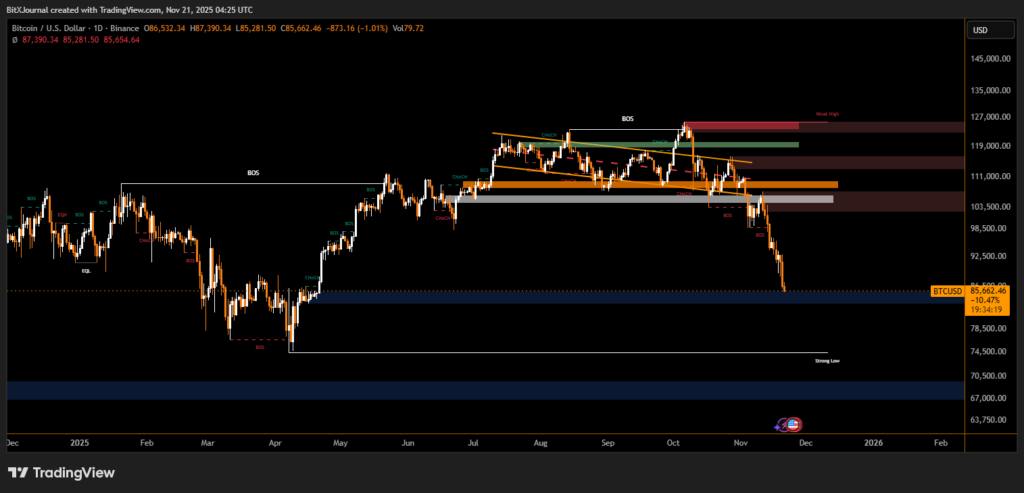

The shock liquidation, which briefly pushed Bitcoin from above $121,000 down toward the mid-$80,000s, has left lasting impacts across trading desks. Analysts now believe the sell-off created significant balance-sheet gaps for several large market-making firms.

Market Makers Under Stress

Tom Lee, chairman of Ether-focused firm BitMine, suggested that the October market event may have forced market makers into a reflexive liquidity retreat.

“They were caught off-guard by the scale of that liquidation,” he said in a recent television interview. “If they’ve taken a hit to their balance sheet, they’re compelled to shrink activity, unwind positions and free up capital.”

Lee compared the role of crypto market makers to a stabilizing force within the ecosystem. “They provide liquidity. They almost behave like central banks in the digital asset market,” he said.

As these firms reduce exposure, trading depth declines — creating an environment where even moderate selling can accelerate price drops. Analysts say this has contributed to the “drip-down” movement seen across Bitcoin and major altcoins in recent weeks.

Signs of a Slow Unwind

Current market activity resembles a smaller echo of the October crash, Lee noted. While not as violent, the ongoing weakness points to a continued attempt by market makers to rebalance risk.

“In 2022, it took nearly eight weeks for a similar liquidity unwind to fully clear. We’re only about six weeks into this one,” he explained.

Industry strategists say the market may need a bit more time before conditions stabilize. Weak liquidity tends to amplify volatility and can act as a leading indicator for broader risk-asset sentiment.

What Comes Next

Bitcoin remains near $86,000 as participants assess whether the unwind is nearing completion. Many analysts believe that once market makers restore balance sheets, trading depth should normalize — potentially easing downward pressure.

For now, the industry is watching whether liquidity returns before further forced selling emerges, marking a critical phase for the digital asset market.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.