Market Liquidity Thins as BTC Drops Toward Multi-Month Lows

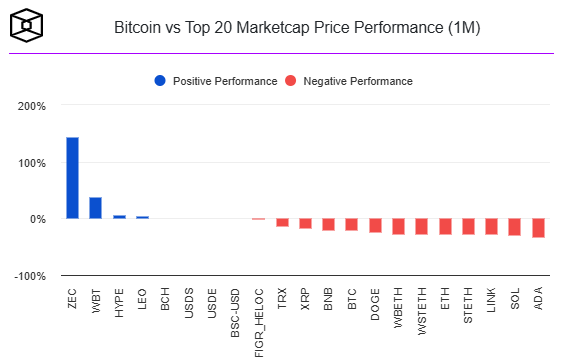

A violent sell-off tore through the crypto market on Friday, triggering nearly $2 billion in leveraged liquidations as Bitcoin briefly collapsed to below $82,000, its lowest level since April. The sudden flush pushed total digital asset capitalization below $3 trillion, marking a break of a key psychological level. More than 396,000 traders were liquidated over 24 hours, highlighting the scale of forced unwinds.

Mass Liquidations Intensify Market Stress

Data compiled by CoinGlass shows that the largest single liquidation — a $36.78 million BTC-USD position — was wiped out on the Hyperliquid decentralized exchange. Analysts caution, however, that true totals may exceed reported figures due to partial and delayed liquidation disclosures on major venues like Binance and OKX.

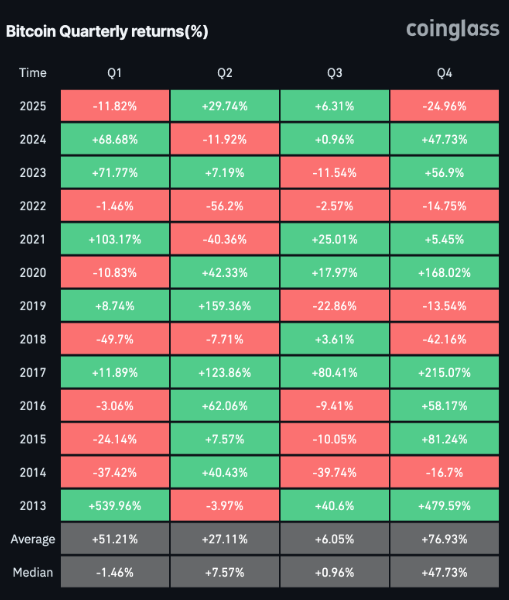

The unwinding intensified after a week of heavy Bitcoin ETF redemptions, including $903 million in outflows on Thursday. Bitcoin is now down more than 30% from its October all-time high, entering what traders describe as one of the steepest downturns since the 2022 market collapse.

Analysts Warn of Capitulation as Bitcoin Breaches Key Metrics

According to Timothy Misir, Head of Research at BRN, the market has entered a zone of accelerated distress. He said Friday’s drawdown pulled the Fear & Greed Index to 11, a level reflecting “extreme distress.”

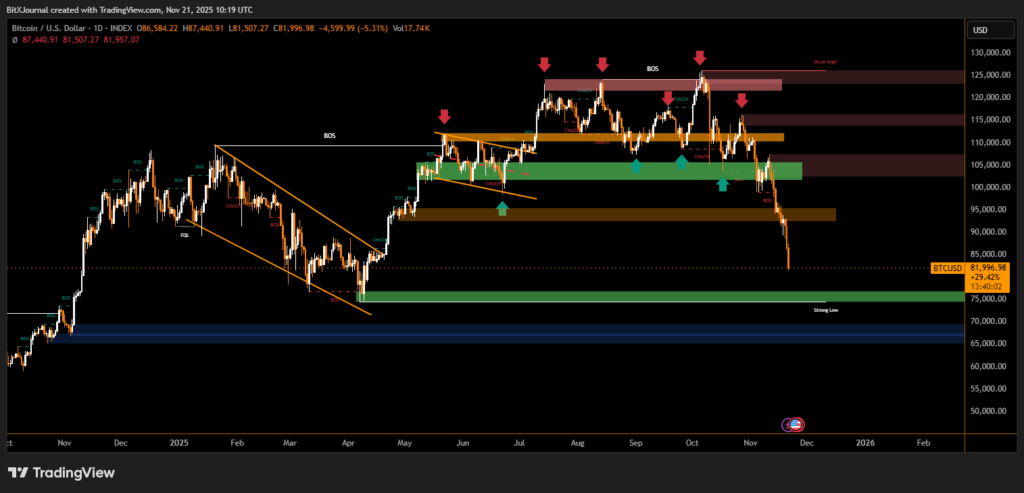

“Bitcoin is now in the capitulation zone, and the market is trading through forced liquidation rather than rationale,” Misir wrote. He added that a failure to reclaim the $88,000–$90,000 region may open a direct slide toward liquidity clusters between $78,000 and $82,000.

Misir emphasized that liquidity is “thinning into a full-scale vacuum,” a condition that often precedes sharp rebounds but requires renewed institutional flows.

Macro Signals Offer Little Cushion

U.S. employment data and shifting expectations around Federal Reserve policy offered mixed signals, while Japan’s $135 billion stimulus package provided limited relief. Analysts agreed that crypto is currently moving on internal liquidation flows rather than macro catalysts.

Where the ‘Max-Pain’ Zone May Form

Andre Dragosch, Head of Research for a major European digital asset firm, said Bitcoin is approaching what he calls the “max-pain zone.” He highlighted two anchor levels: $84,000, aligning with the average cost basis of the largest spot Bitcoin ETF, and $73,000, approximating MicroStrategy’s long-term cost basis.

“Very likely we’ll see a final bottom somewhere between these levels,” he said. “These would be fire-sale prices and resemble a full cycle reset.”

Bitcoin last traded around $81,500, down 10% over 24 hours, with major altcoins seeing similar double-digit declines.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.