Comments from a Federal Reserve official spark a brief uptick in lower-timeframe charts after a sharp intraday sell-off

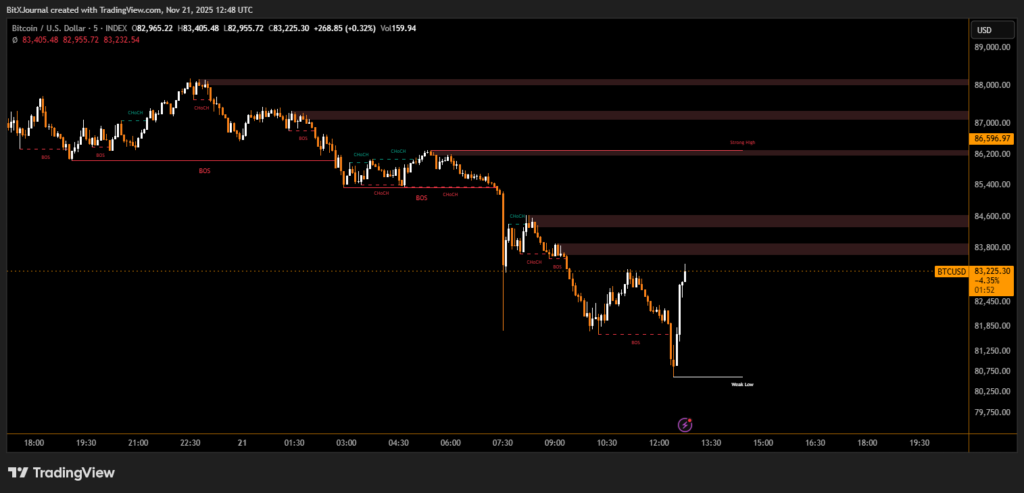

Bitcoin showed its first signs of stabilization on the lower time frames on Thursday after fresh remarks from a Federal Reserve official triggered a modest but noticeable rebound. The move came shortly after the asset slid toward the $81,000–$82,000 liquidity pocket, a region highlighted in market structure charts as a weak low where buyers often begin to reappear. Traders monitoring the rapid downside extension noted that the speech created a momentary shift in sentiment, lifting price off the session’s lows.

FOMC Comments Spark a Technical Reaction

During the session, remarks by a Federal Reserve policymaker introduced a brief wave of optimism, prompting Bitcoin to climb away from the steep sell-off that had defined the morning. The 5-minute chart displayed a clear change of character (ChoCH) inside the demand zone, indicating that short-term traders were beginning to reclaim momentum.

BitXJournal Analysts note that while macroeconomic speeches rarely change trends outright, they can serve as catalysts when price reaches sensitive technical areas. “Whenever Bitcoin tags a deep liquidity zone, any macro headline can become a spark,” one market strategist explained. He added that the combination of oversold intraday conditions and policy-related remarks gave traders a reason to defend the level.

Key Support Zones in Play

The chart shows Bitcoin rebounding from the $80,700–$81,300 demand block, a region traders have been watching for weeks. This area sits beneath multiple layers of break-of-structure (BOS) levels that gave way earlier in the day, reflecting a decisive bearish impulse.

BitXJournal Market technicians argue that the response in this band was significant. “Price respected the deep support beautifully,” said another analyst. “The underlined factor here is that short-term liquidity was absorbed, and buyers stepped in precisely where the orderflow model suggested they might.”

While the short-term bounce provides a glimmer of stability, experts warn that broader volatility remains. The market still faces resistance zones near $83,800–$84,600, areas that previously triggered strong rejections. Until those levels break, conditions remain fragile.

Still, the technical response to today’s remarks reaffirms a long-standing market behavior: Bitcoin often reacts sharply when macro commentary intersects with high-value liquidity zones.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.