Bitcoin, Ether and gold pull back as risk assets reprice; XRP, SOL and ZEC under pressure amid ETF chatter and macro flow

Markets turned decisively lower across the week as risk appetite faded and macro headlines weighed on sentiment. Bitcoin and Ether led the decline, while gold offered a partial safe-haven bid. Altcoins with recent headlines — notably XRP (ETF speculation) and SOL (ETF flows, token unlocks) — moved sharply on volume. At the same time, reports of a near-end to the government shutdown and departments preparing to reopen tempered some panic in fixed income and cash markets.

Macro and macro-driven market moves

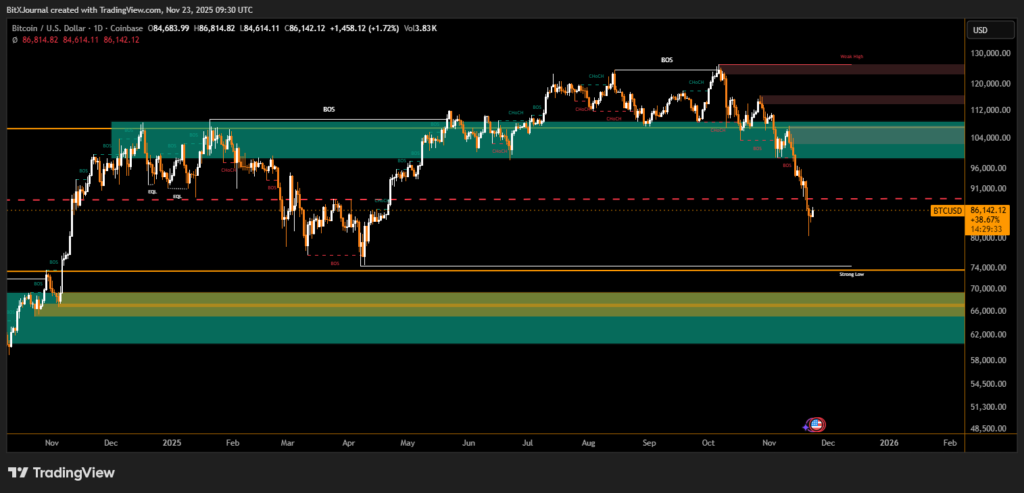

- Bitcoin slipped from five-figure highs into the low-$80k area during the week, printing intraday lows near $81k–$86k as ETF outflows and liquidations accelerated. Traders described the move as a “risk-off repricing” after record weekly ETF withdrawals.

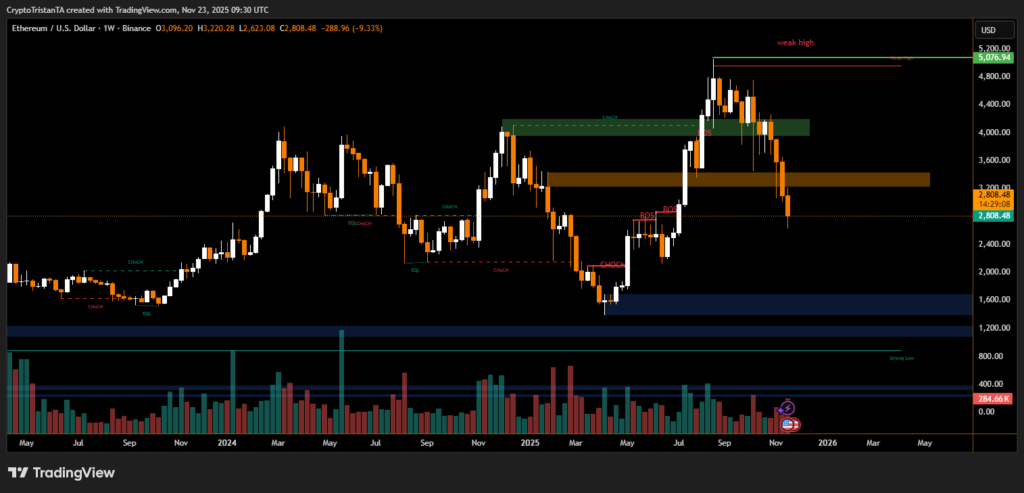

- Ether followed risk assets lower and traded back under the $3,200–$3,000 zone, testing key weekly support near $3k. The pullback eroded some momentum in smart-contract-related tokens.

- Gold remained bid, holding around the $3,900–$4,000 level as investors sought inflation and geopolitical hedges amid market volatility.

Crypto sector highlights

- XRP: ETF hopes and regulatory headlines continued to drive outsized swings. Price action repeatedly tested the $2.10–$2.30 area before a deeper retracement, underscoring fragile conviction around ETF timing. Analysts warn that “ETF flows will continue to amplify price moves until a clear catalyst arrives.”

- Solana (SOL) fell after a technical breakdown below short-term support, trading in the $140–$155 range. Large token unlocks were cited as an additional near-term headwind.

- Zcash (ZEC) underperformed peers; the coin recorded smaller but steady declines as liquidity thinned in lower-cap privacy assets.

- Broad altcoins saw high volume on selloffs and selective bids into deep demand zones.

Policy & macro note

Reports that a government shutdown is near resolution and departments are preparing to reopen softened selling late in the week. A market strategist commented, “Resolution reduces tail-risk for dollar funding and short-term rates — that alone supports a tentative bid for risky assets if confirmed.”

Technical structure remains bearish until Bitcoin reclaims mid-range resistance and Ether stabilizes above $3k. Traders will watch ETF flow reports, the official shutdown resolution, and economic data for the next directional cues.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.