Institutional Selling Pressures Trigger a Major Breakdown in Hedera Hashgraph

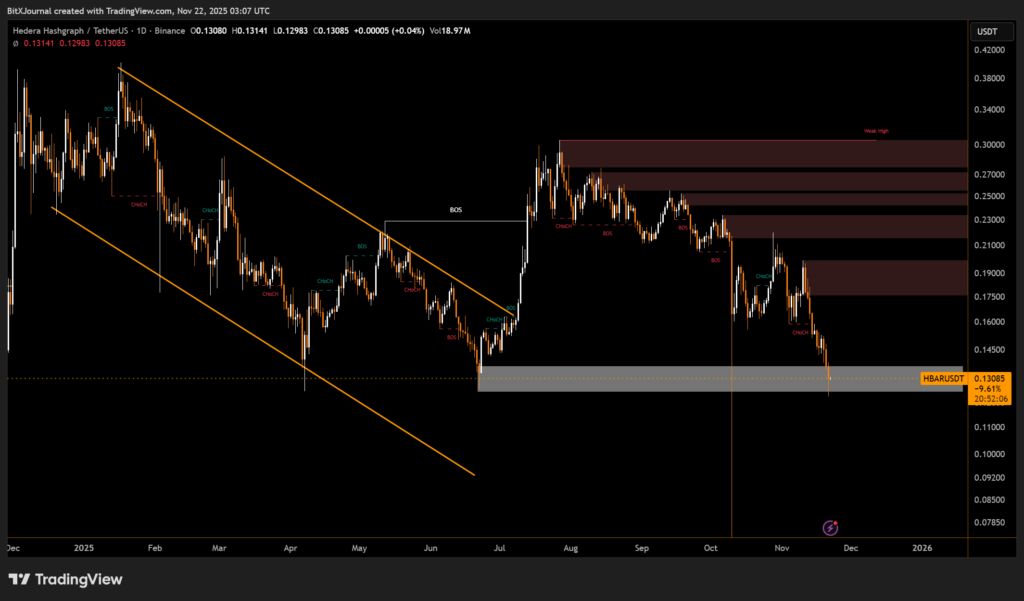

Hedera Hashgraph’s native token, HBAR, suffered a sharp 11.5% decline, breaking decisively below a critical support region highlighted in the chart provided. The move comes alongside a dramatic 98% spike in trading volume, suggesting that large-scale sellers — likely institutional desks — accelerated the downward momentum. With the token now trading near $0.13, the market is confronting one of its most fragile technical moments of the quarter.

HBAR Technical Breakdown Signals Strong Bearish Momentum

The daily chart shows a clear structural deterioration. After months of grinding lower within a descending channel, HBAR briefly attempted a mid-year recovery, breaking structure in July. However, repeated rejections from stacked supply zones between $0.21 and $0.30 reversed the trend back into a bearish phase.

The crucial breakdown occurred when price slipped beneath the grey support band near $0.14 — a region that previously served as the base for HBAR’s summer rebound.

Once this floor gave way, sell-side pressure intensified sharply. BitXJournal nmarket analyst examining the move stated, “Losing that support unravels a lot of built-up liquidity. HBAR has now entered an area with historically thin demand, meaning volatility may increase.”

BitXJournal nstrategist added, “The volume spike shows this wasn’t casual retail selling. This type of expansion typically reflects institutional unwinding or large coordinated repositioning.”

The chart also reveals that every recent rally into the $0.17–$0.23 supply pockets was aggressively sold, confirming a dominant bearish bias even before today’s liquidation event.

Key Levels to Watch

With the former support now broken, traders are monitoring:

- $0.128–$0.135, the immediate reaction zone

- $0.115, a deeper liquidity pocket where the market last formed a higher low

- $0.17, the first significant resistance for any rebound attempt

If HBAR fails to hold above the lower grey zone, the next major demand area sits significantly lower, leaving the token vulnerable to further downside extension.

The sharp 11.5% crash paired with a 98% surge in trading volume marks one of HBAR’s most technically significant breakdowns of 2025. With institutional activity clearly influencing the move, traders will be watching closely to see whether buyers step in at lower demand zones or whether the bearish momentum continues to dominate the market.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.