Experts argue that profit-taking and leveraged flush-outs—not declining demand—are driving recent Bitcoin ETF outflows.

Record BTC ETF Outflows Driven by Short-Term Market Forces

Despite headlines highlighting billions in Bitcoin ETF outflows, analysts say the movement is far from a sign of institutional retreat.

Research teams at Bitfinex report that the recent surge in redemptions reflects short-term tactical rebalancing, triggered by market volatility and broader macro uncertainty.

According to the analysts, long-term Bitcoin holders taking profit and the unwinding of highly leveraged positions have been the primary catalysts behind the sell-off, contributing to both ETF outflows and the sharp decline in Bitcoin’s price.

Institutional Interest in Bitcoin Remains Intact

Bitfinex maintains that the recent turbulence does not mark a structural downturn in institutional appetite for Bitcoin.

“This does not derail the longer-term move toward institutionalization. The spot ETF channel remains intact, and the outflow likely reflects tactical rebalancing rather than a wholesale exit from the asset class,” the firm said.

They argue that the core investment thesis for Bitcoin remains firm, supported by its role as a store-of-value asset with strengthening long-term fundamentals.

Market uncertainty surrounding potential interest rate cuts has contributed to a temporary shift toward risk-off positioning, but analysts expect the institutional growth trend to continue.

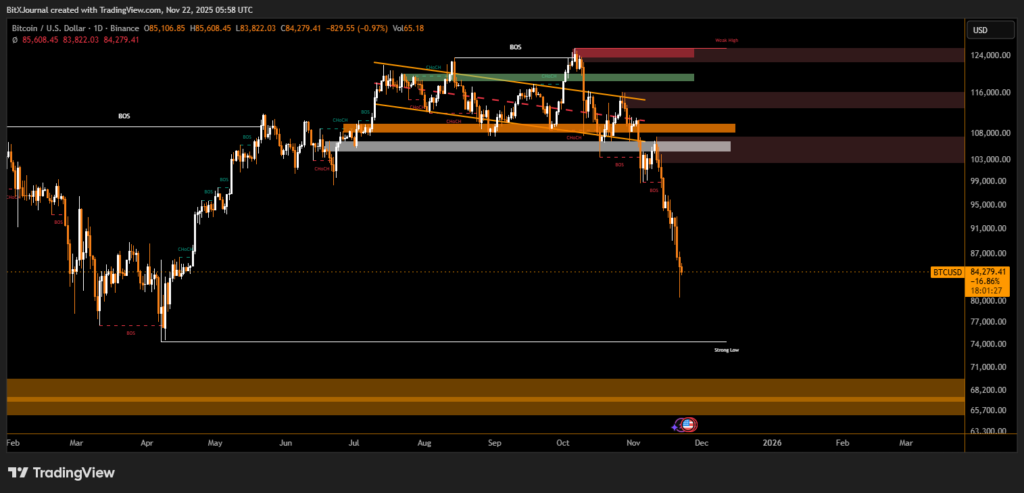

Bitcoin ETFs Bleed Billions Amid Market Panic

Bitcoin ETFs have seen more than $3.7 billion in outflows this month, following the extended downturn triggered in October.

BlackRock’s IBIT posted the largest redemptions, with over $2.47 billion withdrawn in November alone.

Some of the worst daily figures on record occurred this month, with single-day outflows exceeding $900 million, reflecting heightened fear across the market.

Although Bitcoin’s price falling below $90,000 has left the average ETF investor in the red, analysts say large-scale panic selling from ETF holders is unlikely.

Long-Term ETF Investors Remain Steady

Vincent Liu, CIO of Kronos Research, emphasizes that most ETF investors are long-term participants who tend to ignore short-term price swings.

He argues that these buyers are fundamentally different from traders who react quickly to market corrections.

Meanwhile, Bloomberg senior ETF analyst Eric Balchunas notes that the heaviest selling is coming from long-term whales holding Bitcoin directly, not from ETF investors.

Analysts agree that recent Bitcoin ETF outflows are a short-term reaction to market stress—not the beginning of an institutional exodus. With long-term fundamentals intact, the broader trend toward Bitcoin adoption remains firmly on track.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.